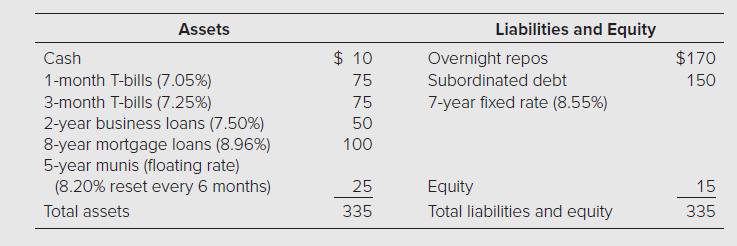

Use the following information about a hypothetical government security dealer named M. P. Jorgan. Market yields are

Question:

Use the following information about a hypothetical government security dealer named M. P. Jorgan. Market yields are in parentheses and amounts are in millions.

a. What is the repricing gap if the planning period is 30 days? 3 months?

2 years? Recall that cash is a non-interest-earning asset.

b. What is the impact over the next 30 days on net interest income if interest rates increase 50 basis points? Decrease 75 basis points?

c. The following one-year runoffs are expected: $10 million for two-year business loans and $20 million for eight-year mortgage loans. What is the oneyear repricing gap?

d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates increase 50 basis points? Decrease 75 basis points?

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 9781266138225

11th International Edition

Authors: Anthony Saunders, Marcia Millon Cornett, Otgo Erhemjamts