21. The Lindscomb family had the following income in 2006: The family made home mortgage payments that

Question:

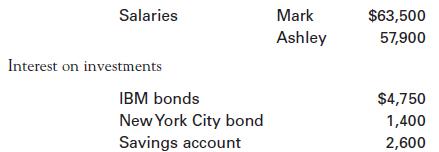

21. The Lindscomb family had the following income in 2006:

The family made home mortgage payments that included interest of $16,480, and paid real estate (property) tax of $4,320 on their home. They also paid state income tax of $5,860 and donated $1,250 to well-known charities. The Lindscombs have three dependent children.

a. Calculate the family’s federally taxable income.

b. What is their tax liability assuming they file jointly as a married couple?

c. What are their average and marginal tax rates?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: