Blackmoore Radiology, a taxpaying entity, is considering a new outpatientimaging center. The building and equipment for the

Question:

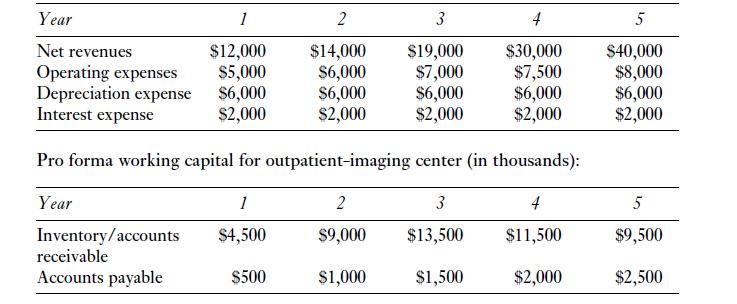

Blackmoore Radiology, a taxpaying entity, is considering a new outpatientimaging center. The building and equipment for the new center will cost $40 million. The equipment and building will be depreciated on a straight-line basis over its five-year life to a $10 million salvage value. The new imaging center’s projected net revenue and expenses are listed below. The project will be financed partially by debt capital. Interest expense is expected to be $2 million per year while principal payments on the bank loan are expected to be $1.5 million per year for the first five years of the loan. The new outpatient-imaging center is expected to take after tax cash profits of $1million per year away from the inpatient imaging. The tax rate for the institution is 40 percent and its cost of capital is 10 percent. Two years ago, a $100,000 financial feasibility study was conducted and paid for. Pro forma working capital projections are listed below.

These are the permanent account balances for inventory, accounts receivable and accounts payable. Use the net present value and internal rate of return approaches to determine if this project should be undertaken?

Pro forma income statement before tax projections for outpatient-imaging center (in thousands):

Step by Step Answer:

Financial Management Of Health Care Organizations

ISBN: 9780631230984

2nd Edition

Authors: William N. Zelman, Michael J. McCue, Alan R. Millikan, Noah D. Glick