Assume that you are the chief financial officer at General Hospital. The CEO has asked you to

Question:

Assume that you are the chief financial officer at General Hospital.

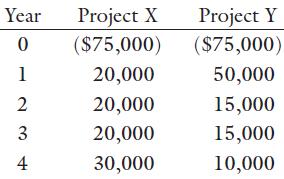

The CEO has asked you to analyze two proposed capital investments—project X and project Y. Each project requires a net investment outlay of $75,000, and the cost of capital for each project is 10 percent. The projects’ expected net cash flows are as follows:

a. Calculate each project’s net present value (NPV) and internal rate of return (IRR).

b. Which project (or projects) is financially acceptable? If you reach different conclusions regarding the financial acceptability of project X and project Y, explain why, given that both projects return total cash flows of $90,000 over the four years.

Step by Step Answer:

Gapenski's Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781640551862

7th Edition

Authors: Kristin L. Reiter, Paula H. Song