Consider this income statement: a. How does this income statement differ from the ones presented in exhibit

Question:

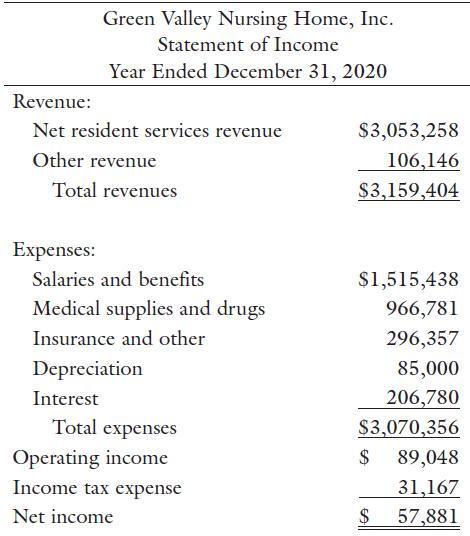

Consider this income statement:

a. How does this income statement differ from the ones presented in exhibit 3.1 and problem 3.2?

b. Why does Green Valley show an income tax expense, while the other two income statements do not?

c. What is Green Valley’s total profit margin? How does this value compare with the values for Sunnyvale Clinic and BestCare?

d. The before-tax profit margin for Green Valley is operating income divided by total revenues. Calculate Green Valley’s before-tax profit margin. Why might this be a better measure of expense control when comparing an investor-owned business with a not-for-profit business?

Problem 3.2

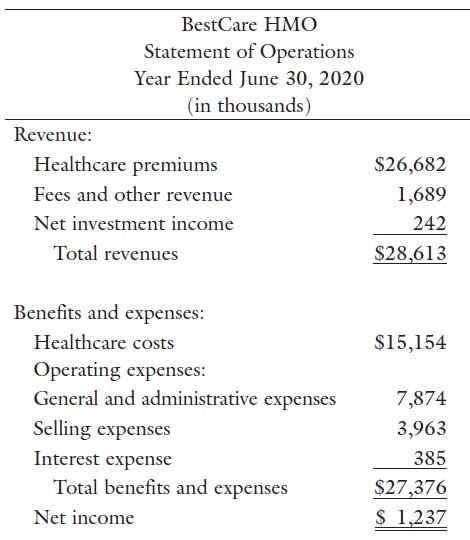

Consider the following income statement:

a. How does this income statement differ from the one presented in exhibit 3.1?

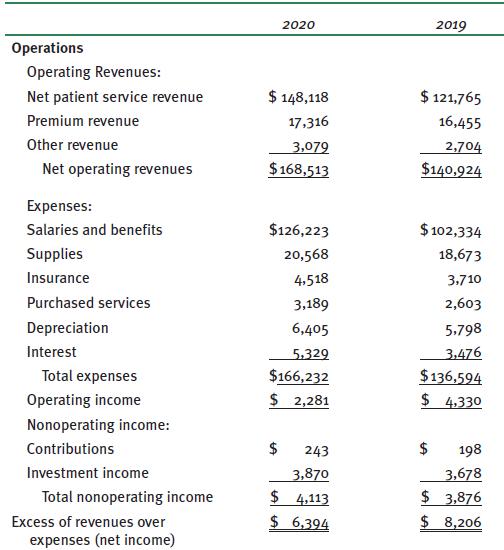

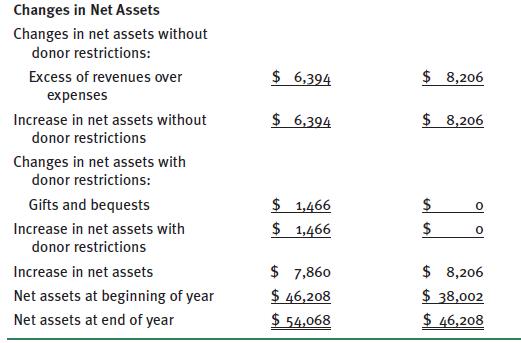

Exhibit 3.1

b. What is BestCare’s total profit margin? How can it beinterpreted?

Step by Step Answer:

Gapenski's Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781640551862

7th Edition

Authors: Kristin L. Reiter, Paula H. Song