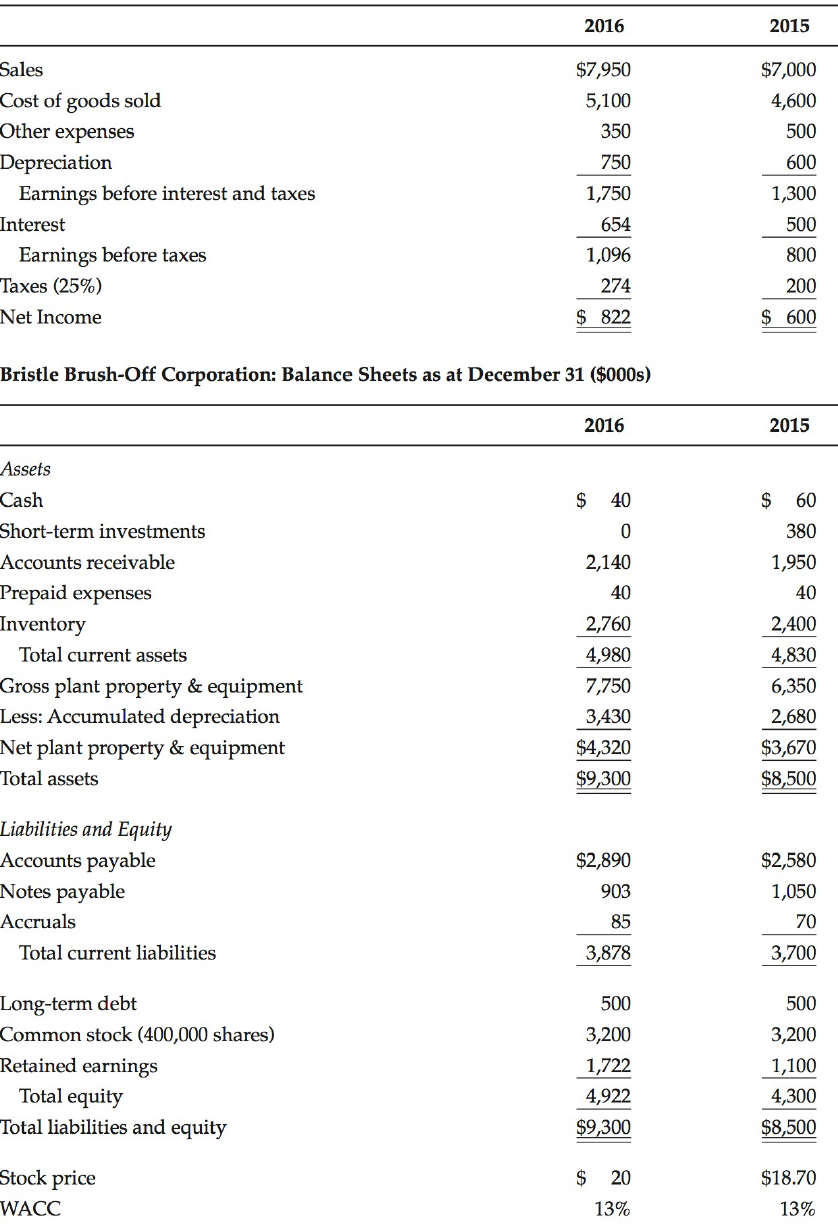

Financial information on Bristle Brush-Off Corp. is shown below. Calculate the following for 2016: a. Free cash

Question:

Financial information on Bristle Brush-Off Corp. is shown below. Calculate the following for 2016:

a. Free cash flow

b. ROIC

c. EVA and MVA

Bristle Brush-Off Corporation: Income Statements for Years Ended December 31 ($000s)

Transcribed Image Text:

2016 2015 Sales $7,950 $7,000 Cost of goods sold Other expenses 5,100 4,600 500 350 Depreciation 750 600 Earnings before interest and taxes 1,750 1,300 Interest 500 654 Earnings before taxes Taxes (25%) 1,096 800 274 200 $ 822 Net Income $ 600 Bristle Brush-Off Corporation: Balance Sheets as at December 31 ($000s) 2015 2016 Assets Cash $ 60 40 Short-term investments 380 Accounts receivable 2,140 1,950 Prepaid expenses Inventory 40 40 2,760 2,400 4,980 Total current assets 4,830 Gross plant property & equipment Less: Accumulated depreciation 7,750 6,350 2,680 З430 Net plant property & equipment Total assets $4,320 $3,670 $9,300 $8,500 Liabilities and Equity Accounts payable Notes payable $2,890 $2,580 1,050 903 Accruals 85 70 Total current liabilities 3,878 3,700 Long-term debt Common stock (400,000 shares) Retained earnings Total equity Total liabilities and equity 500 500 3,200 3,200 1,722 1,100 4,922 4,300 $9,300 $8,500 Stock price WACC $ 20 $18.70 13% 13%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

a NOPAT EBIT1 T 1750000075 1312500 NOWC15 Operating CA Operating CL 483...View the full answer

Answered By

Emel Khan

I have the ability to effectively communicate and demonstrate concepts to students. Through my practical application of the subject required, I am able to provide real-world examples and clarify complex ideas. This helps students to better understand and retain the information, leading to improved performance and confidence in their abilities. Additionally, my hands-on approach allows for interactive lessons and personalized instruction, catering to the individual needs and learning styles of each student.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted:

Students also viewed these Business questions

-

a. Using the financial statements shown below for Lan & Chen Technologies, calculate net Cash Flows, EVA, operating working capital, total net operating capital, net operating profit after taxes, and...

-

How much money will you have in your bank account in 5 years if it pays 4% annually and you start with the following amounts. a. $5,000. b. $10,000. c. $15,000. d. $20,000.

-

You have decided to become a homeowner with the purchase of a condominium in a newly redeveloped part of town. The condo costs $300,000 and you have a down payment of $90,000, so you will be carrying...

-

Hines stored her furniture, including a grand piano, in Arnetts warehouse. Needing more space, Arnett stored Hiness piano in Butlers warehouse next door. As a result of a fire, which occurred without...

-

Show that the diagonal entries of any hermitian matrix are real.

-

Find I z , for the given lamina with uniform density of 1. Use a computer algebra system to verify your results. x + y = a, 0 z h

-

3. When should the unrealized profit or loss from inventory be realized in intercompany sales transactions?

-

Organizational Kings performs organizational consulting services on account, so virtually all cash receipts arrive in the mail. Average daily cash receipts are $36,000. Katie Stykle, the owner, has...

-

What kinds of options was it likely that these investors were buying? To protect strong gains they are likely buying put options How would these investors use these contracts to hedge? When an...

-

From the e-Activity, contrast the differences between a stock dividend and a stock split. Imagine that you are a stockholder in a company. Determine whether you would prefer to see the company that...

-

Using the information from 2-12, prepare the cash flow statement for Rhodes Corporation. Information from 2-12: Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars)...

-

Using the information from 22-16, create a cash flow statement for 2016. Information from 22-16: Bristle Brush-Off Corporation: Income Statements for Years Ended December 31 ($000s) 2016 2015 Sales...

-

Suppose that the economy is known to be producing at potential output. In other words, the output gap is zero. a. Graph the economys initial equilibrium using the ISMP model including the Phillips...

-

Pacifico Company, a U . S . - based importer of beer and wine, purchased 1 , 7 0 0 cases of Oktoberfest - style beer from a German supplier for 4 5 9 , 0 0 0 euros. Relevant U . S . dollar exchange...

-

Consider each of the following scenarios and identify a behavioral intervention to address each issue in family work. A teenager not complying with curfew. One member of the couple not picking up...

-

Sandy Crane Hospital expanded its maternity ward to add patient rooms for extended hospital stays. They negotiated a 15-year loan with monthly payments and a large sum of $250,000 due at the end of...

-

2 (39 marks) R QUESTION 2 (39 marks) Roundworm Ltd is a group of companies with a 31 December year-end. The Roundworm group financial statements for the years 20.21 and 20.22 are given below:...

-

Vino Veritas Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,400 cases of wine at a price of 240 euros per case. The total purchase price is 336,000...

-

For the following exercises, find the zeros and give the multiplicity of each. f(x) = (2x + 1) 3 (9x 2 6x + 1)

-

Tarick Toys Company manufactures video game consoles and accounts for product costs using process costing. The following information is available regarding its June inventories. The following...

-

Betty Simmons, the new financial manager of Okanagan Chemicals Ltd. (OCL), a B.C. producer of specialized chemicals for use in fruit orchards, must prepare a financial forecast for 2013. OCL's 2012...

-

Four years ago, Guard Co. sold a 20-year bond issue with a 7% annual coupon rate and a 9% call premium. Today, Guard Co. called the bonds. The bonds originally were sold at their face value of...

-

A 10-year, 12% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,060. The bond sells for $1,100. (Assume that the bond has just been issued.) a. What is...

-

nformation pertaining to Noskey Corporation s sales revenue follows: November 2 0 2 1 ( Actual ) December 2 0 2 1 ( Budgeted ) January 2 0 2 2 ( Budgeted ) Cash sales $ 1 0 5 , 0 0 0 $ 1 1 5 , 0 0 0...

-

The management team of Netflix maintains a stable dividend using the Lintner model: Dt+1 = Dt + EPS Target Payout Where Dt (Dt+1) = dividend in the current period t (the next period t + 1) EPSt =...

-

#1 #2 hapter 50 10 D Werences lav Help Required information [The following information applies to the questions displayed below) Archer Company is a wholesaler of custom-built air-conditioning units...

Study smarter with the SolutionInn App