Grandview Clinic has fixed costs of $2 million and an average variable cost rate of $15 per

Question:

Grandview Clinic has fixed costs of $2 million and an average variable cost rate of $15 per visit. Its sole payer, an HMO, has proposed an annual capitation payment of $150 for each of its 20,000 members. Past experience indicates the population served will average two visits per year.

a. Construct the base case projected P&L statement on the contract.

b. Sketch two CVP analysis graphs for the clinic—one with number of visits on the x axis and one with number of members on the x axis. Compare and contrast these graphs with the one in problem 5.3.d.

c. What is the clinic’s contribution margin on the contract per visit?

What is the contribution margin per member? How do these values compare with the value in problem 5.3.b?

d. What profit gain can be realized if the clinic can lower per member utilization to 1.8 visits?

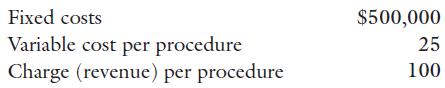

Problem 5.3.

Assume that a radiologist group practice has the following cost structure:

Furthermore, assume that the group expects to perform 7,500 procedures in the coming year.

b. What is the group’s contribution margin? What is its accounting breakeven point?

d. Sketch out a CVP analysis graph depicting the base case situation.

Now assume that the practice contracts with one HMO, and the plan proposes a 20 percent discount from charges.

Step by Step Answer:

Gapenski's Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781640551862

7th Edition

Authors: Kristin L. Reiter, Paula H. Song