Michigan Health Center, a for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which

Question:

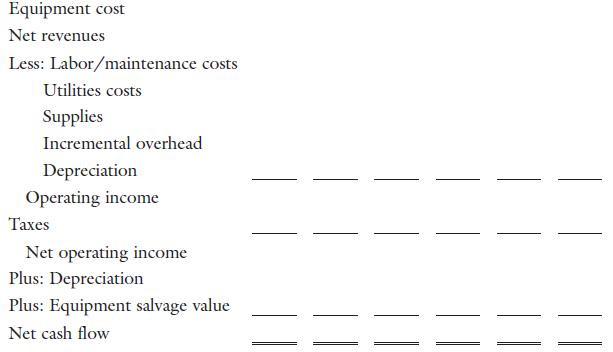

Michigan Health Center, a for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated pretax salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day for 250 days a year for each year of the project’s life. On average, each procedure is expected to generate $80 in collections, which is net of bad debt losses and contractual allowances, in its first year of use. Thus, net revenues for year 1 are estimated at 15 × 250 × $80 = $300,000.

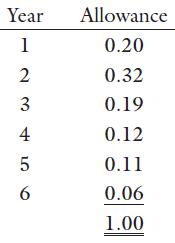

Labor and maintenance costs are expected to be $100,000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in year 1. The cost for expendable supplies is expected to average $5 per procedure during the first year. All costs and revenues, except depreciation, are expected to increase at a 5 percent inflation rate after the first year. The equipment falls into the MACRS five-year class for tax depreciation and is subject to the following depreciation allowances:

The hospital’s tax rate is 30 percent, and its corporate cost of capital is 10 percent.

a. Estimate the project’s net cash flows over its five-year estimated life.

b. What are the project’s NPV and IRR? (Assume for now that the project has average risk.)

Step by Step Answer:

Gapenski's Healthcare Finance An Introduction To Accounting And Financial Management

ISBN: 9781640551862

7th Edition

Authors: Kristin L. Reiter, Paula H. Song