Rework Problem 23-7. After completing parts a through d, answer the following related questions. a. Calculate Dearborn's

Question:

Rework Problem 23-7. After completing parts a through d, answer the following related questions.

a. Calculate Dearborn's yearly free cash flows.

b. Calculate Dearborn's WACC.

c. Calculate horizon value using the corporate valuation method.

d. Calculate Dearborn's value of operations, value of equity, and maximum share price that Brock would be willing to pay.

e. Calculate Dearborn's yearly free cash flow to equity from 2009-2014.

f. Calculate Dearborn's horizon value using the free cash flow to equity model.

g. Calculate Dearborn's value of equity and the maximum share price that Brock would be willing to pay based on the information in e and f.

h. What would be Dearborn's value of equity if the growth rate "g" varied ±1%.

Data from Problem 23-7:

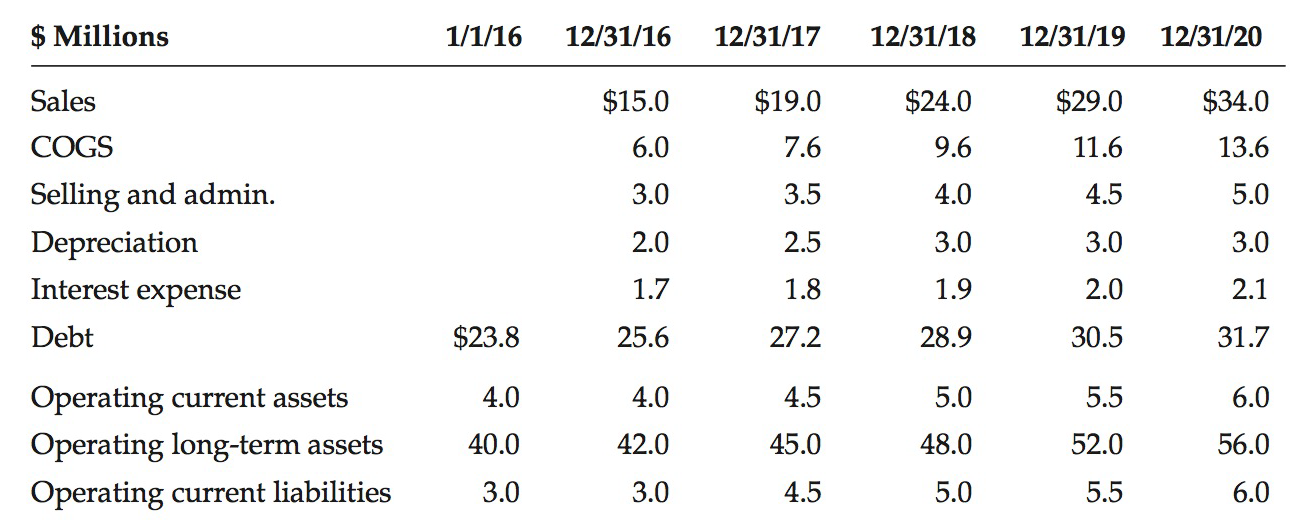

Brock Industries is contemplating whether to make a takeover bid for Dearborn Aerospace. Dearborn currently has $16 million of debt at 7%, and the market value of its equity is $34 million. Dearborn's tax rate is 35%. The following financial information, which includes all synergies, has been forecast for Dearborn Aerospace if the acquisition takes place. Dearborn's long-term growth rate is expected to be 4% per year.

Additional market information is shown below:

Risk-free rate is 3%.

Market risk premium is 5%.

Dearborn's stock beta is 1.4.

Dearborn has 5 million shares outstanding.

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason