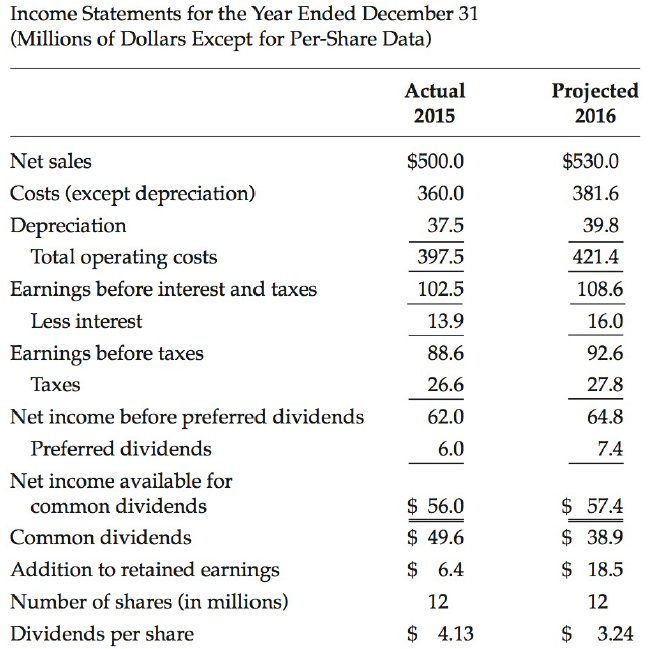

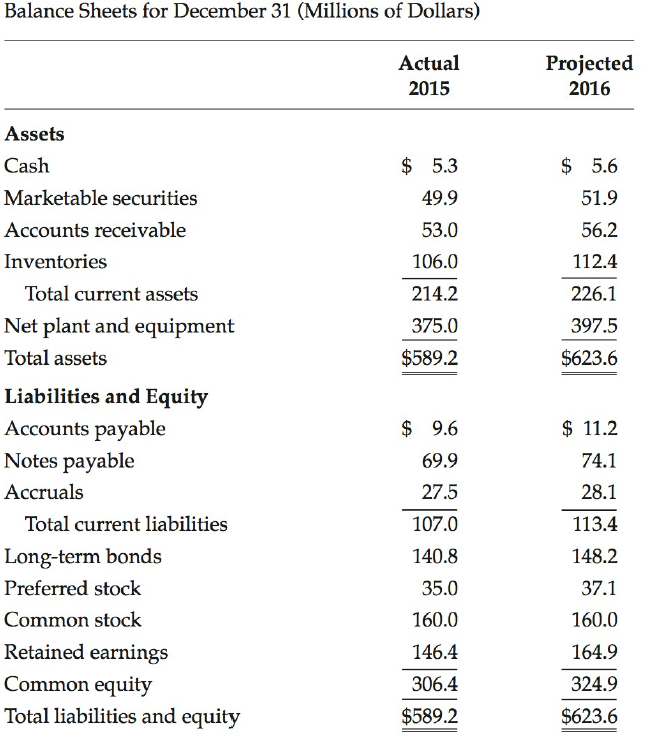

The financial statements of Can Cable Fabricators are shown below, with the actual results for 2015 and

Question:

The financial statements of Can Cable Fabricators are shown below, with the actual results for 2015 and the projections for 2016. Free cash flow is expected to grow at a 5% rate after 2016. The weighted average cost of capital is 10%.

a. If operating capital as of December 31, 2015 is $502.2 million, what is the free cash flow for December 31, 2016?

b. What is the horizon value as of December 31, 2016?

c. What is the value of operations as of December 31, 2015?

d. What is the total value of the company as of December 31, 2015?

e. What is the price per share for December 31, 2015?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted: