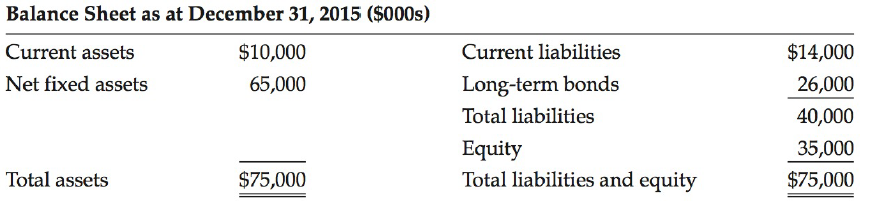

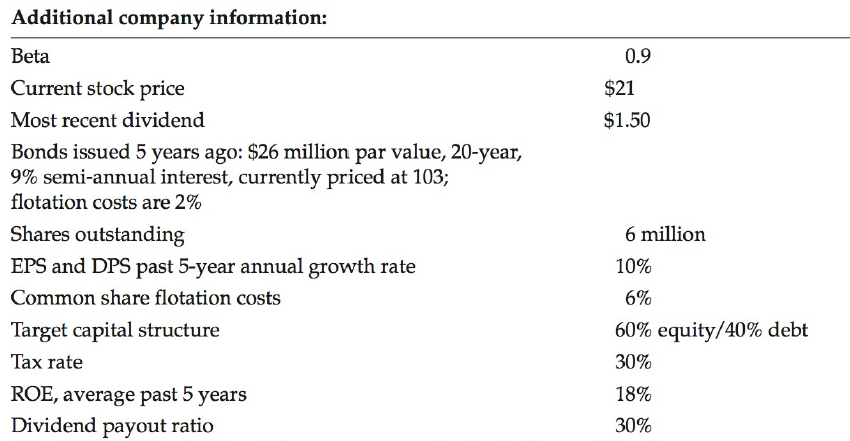

Your boss has asked you to estimate your company's WACC. You have assembled the following information: Current

Question:

Your boss has asked you to estimate your company's WACC. You have assembled the following information:

Current liabilities consist of short-term par value bank debt at 3% to finance seasonal assets. This debt is paid off in the off-season.

Your company has been experiencing very rapid earnings and dividend growth, though the market for your products has matured, and going forward you expect growth to be tied to the overall economy's growth. You also realize that the market and your company's stock have risen dramatically recently, and you seriously question whether the stock price is sustainable. Any new equity needed comes from internal sources.

Market information:

Current 90-day T-hill rate ..................................................................2.25%

Historical 90-day T-hill rate .............................................................. 3.9%

Historical average 10-year risk-free bond rate ............................. 7.75%

Current 10-year risk-free bond rate ...............................................5.0%

Expected market return...................................................................11.0%

Expected long-term annual GOP growth rate ................................2%

a. Determine whether the weighting for each component cost of capital should be based on the existing market values or the target weighting. Explain your answer.

b. Calculate the WACC.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason