(Calculating changes in net operating working capital) Faraway Fabricators, Inc., is considering the expansion of its welding...

Question:

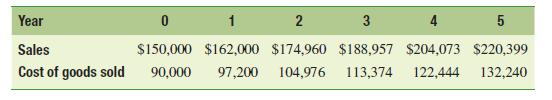

(Calculating changes in net operating working capital) Faraway Fabricators, Inc., is considering the expansion of its welding and stamping division and estimates that this will require the firm’s accounts receivable to increase by 12 percent of the added sales. Moreover, Faraway estimates that inventories will be 15 percent of the added cost of goods sold, while accounts payable will be 10 percent of that added cost. The firm’s CFO estimates that its sales and cost of goods sold over the five-year estimated life of the investment are as follows:

a. What are the (operating) working-capital requirements of the project for Years 1 through 5? (Hint: You can assume that the expenditure for operating net working capital for Year 1 is made in Year 0 and so forth.)

b. How much additional money must Faraway invest annually because of its working-

capital requirements?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9781292222189

13th Global Edition

Authors: Sheridan Titman, Arthur Keown, John Martin