(Calculating EAC) (Related to Checkpoint 11.2 on page 370) Barry Boswell is a financial analyst for Dossman...

Question:

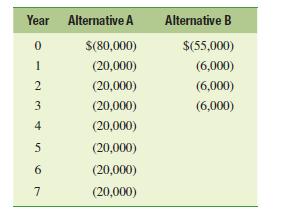

(Calculating EAC) (Related to Checkpoint 11.2 on page 370) Barry Boswell is a financial analyst for Dossman Metal Works, Inc., and he is analyzing two alternative configurations for the firm’s new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $80,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows:

a. Calculate each project’s EAC, given a 10 percent discount rate.

b. Which of the alternatives do you think Barry should select? Why?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9781292222189

13th Global Edition

Authors: Sheridan Titman, Arthur Keown, John Martin