(Calculating the weighted average cost of capital) You are working as a consultant to the Lulu Athletic...

Question:

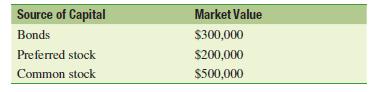

(Calculating the weighted average cost of capital) You are working as a consultant to the Lulu Athletic Clothing Company, and you have been asked to compute the appropriate discount rate to use in the evaluation of the purchase of a new warehouse facility. You have determined the market value of the firm’s current capital structure

(which the firm considers to be its target mix of financing sources) as follows:

To finance the purchase, Lulu will sell 20-year bonds with a $1,000 par value paying 6 percent per year (with interest paid semiannually) at the market price of $1,020.

Preferred stock paying a $2.50 dividend can be sold for $35. Common stock for Lulu is currently selling for $50 per share. The firm paid a $4 dividend last year and expects dividends to continue growing at a rate of 4 percent per year for the indefinite future. The firm’s marginal tax rate is 34 percent. What discount rate should you use to evaluate the warehouse project?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9781292222189

13th Global Edition

Authors: Sheridan Titman, Arthur Keown, John Martin