(Computing floating-rate loans) (Related to Checkpoint 9.1 on page 292) The Bensington Glass Company entered into a...

Question:

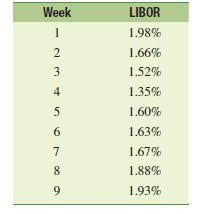

(Computing floating-rate loans) (Related to Checkpoint 9.1 on page 292) The Bensington Glass Company entered into a loan agreement with the firm’s bank to finance the firm’s working capital. The loan called for a floating interest rate that was 30 basis points

(.30 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.2 percent and a minimum annual rate of 1.75 percent. Calculate the rate of interest for Weeks 2 through 10.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9781292222189

13th Global Edition

Authors: Sheridan Titman, Arthur Keown, John Martin

Question Posted: