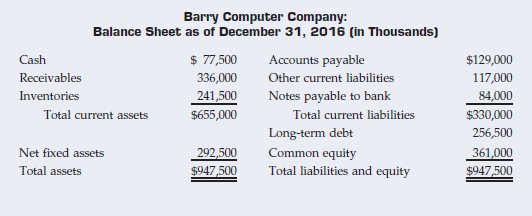

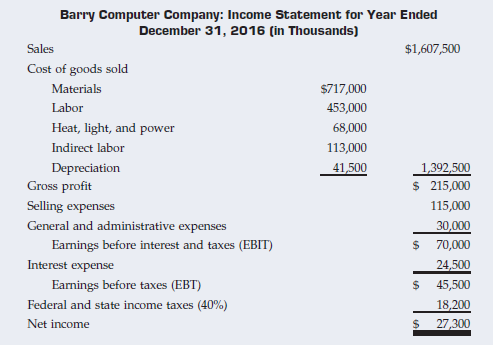

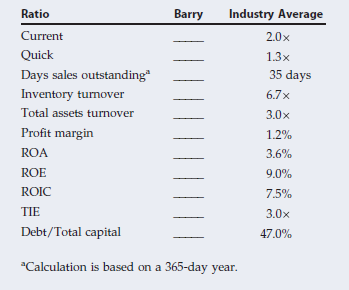

Data for Barry Computer Co. and its industry averages follow. a. Calculate the indicated ratios for Barry.

Question:

a. Calculate the indicated ratios for Barry.

b. Construct the DuPont equation for both Barry and the industry.

c. Outline Barry€™s strengths and weaknesses as revealed by your analysis.

d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 2016. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.)

Transcribed Image Text:

Barry Computer Company: Balance Sheet as of December 31, 2016 (in Thousands) $ 77,500 Cash Accounts payable $129,000 Receivables 336,000 Other current liabilities 117,000 Inventories 241,500 $655,000 Notes payable to bank 84,000 Total current assets Total current liabilities $330,000 Long-term debt 256,500 Common equity Net fixed assets 292,500 $947,500 361,000 Total liabilities and equity Total assets $947,500 Barry Computer Company: Income Statement for Year Ended December 31, 2016 (in Thousands) Sales $1,607,500 Cost of goods sold Materials $717,000 Labor 453,000 Heat, light, and power 68,000 Indirect labor 113,000 41,500 1,392,500 Depreciation Gross profit Selling expenses $ 215,000 115,000 General and administrative expenses 30,000 Earnings before interest and taxes (EBIT) 70,000 Interest expense 24,500 Earnings before taxes (EBT) 45,500 Federal and state income taxes (40%) 18,200 Net income %24 27,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (18 reviews)

a Dollar amounts in thousands b For the firm ROE NIS STA X TAE 17 17 947500361000 76 For the industr...View the full answer

Answered By

Allan Olal

I have vast tutoring experience of more than 8 years and my primary objective as a tutor is to ensure that a student achieves their academic goals.

4.70+

78+ Reviews

412+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-1305635937

Concise 9th Edition

Authors: Eugene F. Brigham

Question Posted:

Related Video

The Dupont analysis is an expanded return on equity formula, calculated by multiplying the net profit margin by the asset turnover by the equity multiplier. The DuPont analysis is also known as the DuPont identity or DuPont model.This Video will guide on how to calculate return on Equity and estimate profitability of shareholders using DuPont Analysis.

Students also viewed these Finance questions

-

Data for Barry Computer Co. and its industry averages follow. a. Calculate the indicated ratios for Barry. b. Construct the DuPont equation for both Barry and the industry. c. Outline Barry's...

-

Data for Barry Computer Company and its industry averages follow. a. Calculate the indicated ratios for Barry. b. Construct the extended Du Pont equation for both Barry and the industry. c. Outline...

-

Data for Lozano Chip Company and its industry averages follow. a. Calculate the indicated ratios for Lozano. b. Construct the extended DuPont equation for both Lozano and the industry. c. Outline...

-

A plank with a mass M = 6.00 kg rides on top of two identical solid cylindrical rollers that have R = 5.00 cm and m = 2.00 kg (Fig. P10.86). The plank is pulled by a constant horizontal force F of...

-

How do differences in income levels and income distribution among nations affect international businesses?

-

In Chapter 4, Exercise 38, we saw an ogive of the distribution of cholesterol levels (in mg/dL) of a random sample of 1406 participants (taken in 1948 from Framingham, MA). To find a bootstrap...

-

C2.12. Why is the matching principle important?

-

1. Joe earns $39,000 per year, and he's paid monthly. His employer offers a 401(k) plan with 50% matching up to 9% of salary. What is the minimum amount of money that Joe needs to contribute to his...

-

Velor Inc. was authorized to issue 400,000 $2.00 preferred shares and 650,000 common shares. During April 2014, their first month of operations, the following selected transactions occurred: a April...

-

Silver ion in methanol was exchanged with sodium ion using Dowex 50 cross-linked with 8% divinyl benzene by Gable and Stroebel [J. Phys. Chem., 60, 513-517 (1956)]. The molar selectivity coefficient...

-

The shareholders equity accounts of Tsui, Inc. at December 31, 2013, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 4,000 issued ..................................

-

A firm has been experiencing low profitability in recent years. Perform an analysis of the firms financial position using the DuPont equation. The firm has no lease payments but has a $2 million...

-

Suppose the following two independent investment opportunities are available to Relax, Inc. The appropriate discount rate is 8.5 percent. Year ....................Project Alpha ..............Project...

-

Sample grade point averages for ten male students and ten female students are listed. Males 2.4 3.7 3.8 3.9 Females 2.8 3.7 2.1 3.9 2.8 2.6 3.6 3.3 4.0 1.9 3.6 4.0 2.0 3.9 3.7 2.3

-

Fill in the columns in the following table. What quantity should a profit-maximizing firm produce? Verify your answer with marginal reasoning. 9 0 1 2 3 st 4 5 6 TFC $5 5 5 5 5 5 5 TVC $0 3 5 9 16 25...

-

Perform the experiments in Problems 48-51, tally your results, and calculate the probabilities (to the nearest hundredth). Flip three coins simultaneously 100 times, and note the results. The...

-

The following information is available for Spring Inc. and Winter Inc. at December 31, 2011: Required a. What is the accounts receivable turnover for each of the companies for 2011? b. What is the...

-

Margin of error = 0.5 g, standard deviation = 8.7 g

-

Write each number as a product of a real number and i. Simplify all radical expressions. -V-196

-

Juanita owns a home in Richardson, TX. She purchases a Homeowners Policy (HO-3) from Farm State Ins. Co. The policy provides $100,000 in liability coverage (coverage E) and $5,000 in Med Pay coverage...

-

The SEC attempts to protect investors who are purchasing newly issued securities by making sure that the information put out by a company and its investment bankers is correct and is not misleading....

-

The SEC attempts to protect investors who are purchasing newly issued securities by making sure that the information put out by a company and its investment bankers is correct and is not misleading....

-

The SEC attempts to protect investors who are purchasing newly issued securities by making sure that the information put out by a company and its investment bankers is correct and is not misleading....

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App