Start with the partial model in the file Ch27 P15 Build a Model.xlsx on the textbooks Web

Question:

Start with the partial model in the file Ch27 P15 Build a Model.xlsx on the textbook’s Web site. Mark Collins, luthier and businessman, builds and sells custom-made acoustic and electric stringed instruments. Although located in Maryville, Tennessee, he purchases raw materials from around the globe.

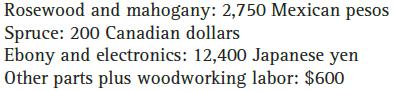

For example, he constructs his top-of-the line acoustic guitar with onboard electronics, the MC-28, from rosewood and mahogany imported from a distributor in Mexico, spruce harvested in and imported from Canada, and ebony and the electronics imported from a Japanese distributor. He obtains other parts in the United States. When broken down on a per-guitar basis, the component and finishing costs are as follows:

Collins sells some of this model in the United States, but the majority of the units are sold in England, where he has developed a loyal following and the guitars have become something of a cult symbol. There, his guitars fetch £1,600, excluding shipping. Mark is concerned about the effect of exchange rates on his materials costs and profit.

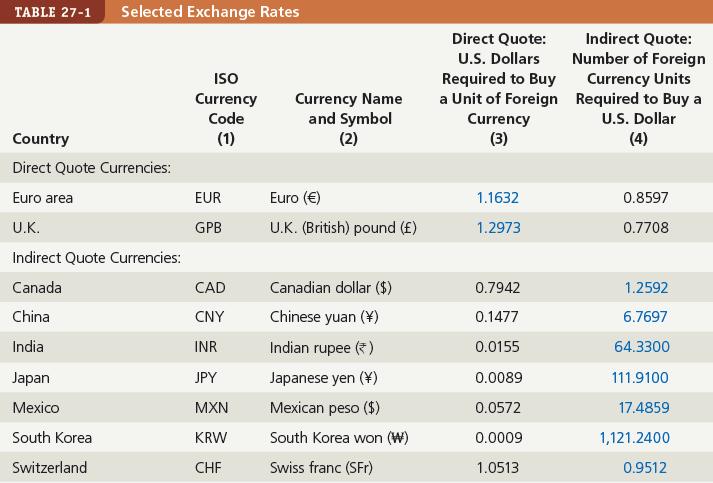

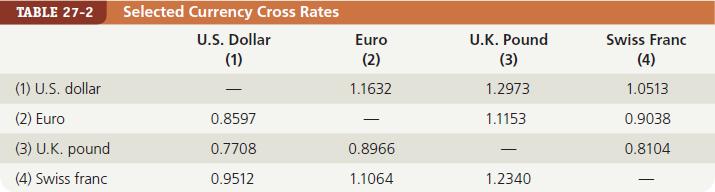

You will find Tables 27-1 and 27-2 useful for this problem.

a. How much, in dollars, does it cost for Collins to produce his MC-28?

What is the dollar sale price of the MC-28 sold in England?

b. What is the dollar profit that Collins makes on the sale of the MC-28?

What is the percentage profit?

c. If the U.S. dollar were to depreciate by 10% against all foreign currencies, what would be the dollar profit for the MC-28?

Tables 27-1

Tables 27-2

Step by Step Answer:

Intermediate Financial Management

ISBN: 9781337395083

13th Edition

Authors: Eugene F. Brigham, Phillip R. Daves