SunTrek Corporation is the leading U. S. producer of equipment for aerospace. SunTrek currently has over 60,000

Question:

SunTrek Corporation is the leading U. S. producer of equipment for aerospace. SunTrek currently has over 60,000 shares of common stock outstanding. The price of a share of stock at the end of 1997 was $42, but the stock traded in the range of $35 to $42 during 1997. SunTrek’s earnings and dividends are expected to grow at a rate of 10% each year over the next few years. In anticipation of the increased rate of growth, SunTrek’s board of directors declared a 2 for 1 stock split, effective in March, 1998.

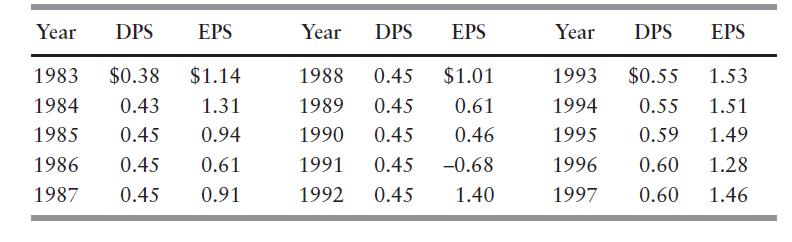

Its earnings per share (EPS) and dividends per share (DPS) over the period from 1983 through 1997 (based on pre-split shares) a represented in following table.

a. Describe SunTrek’s dividend policy in terms of dividends per share and dividend payout. Provide graphs to illustrate Sun-

Trek’s policy.

b. What stock price change, if any, do you expect when the shares are split in March of 1998? Explain.

c. Discuss the reasoning behind SunTrek’s splitting its shares. Do you agree with SunTrek’s board’s decision to split the shares?

Explain.

d. Suppose that there is a difference of opinion regarding SunTrek’s future growth, with estimates of future growth ranging from 5%

to 14%, and a median estimate of 10%. Considering the difference of opinion on SunTrek’s future growth, discuss the wisdom of splitting its shares.

Step by Step Answer:

Financial Management And Analysis (Frank J. Fabozzi Series)

ISBN: 9780471477617

2nd Edition

Authors: Frank J. Fabozzi, Pamela P. Peterson