The case study indicates that the City of Lakeview will not have any additional debt capacity two

Question:

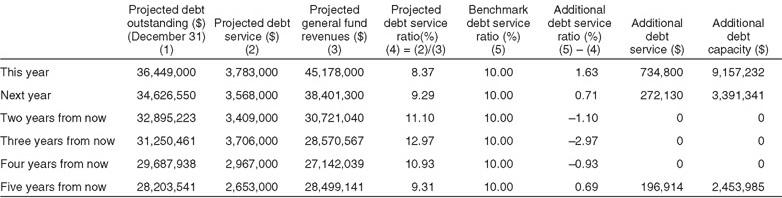

The case study indicates that the City of Lakeview will not have any additional debt capacity two years from now. The additional debt service ratio is negative (−1.10 percent), indicating that the city must reduce its existing debt outstanding amount to maintain the debt service ratio at the benchmark level (10 percent). Assume an annual interest rate of 5 percent and a twenty-year maturity for the debt. How much of the projected debt outstanding in that year

($32.90 million) should the city reduce in order to keep its debt service ratio at the benchmark level?

Refer to the debt data three years from now in Table 13.3. Assume an annual interest rate of 5 percent and a twenty-year maturity for the debt. How much of the existing debt outstanding in that year ($31.25 million) should the city reduce in order to keep its debt service ratio at the benchmark level?

Refer to the debt data four years from now in Table 13.3. Assume an annual interest rate of 5 percent and a twenty-year maturity for the debt. How much of the existing debt outstanding in that year ($29.69 million) should the city reduce in order to keep its debt service ratio at the benchmark level?

Step by Step Answer:

Financial Management In The Public Sector Tools Applications And Cases

ISBN: 9780765636898

3rd Edition

Authors: Xiaohu Wang