(Working with international capital budgeting) (Related to Checkpoint 19.3 on page 653) Assume you are working for...

Question:

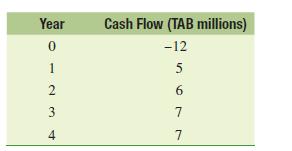

(Working with international capital budgeting) (Related to Checkpoint 19.3 on page 653) Assume you are working for a firm based in the United States that is considering a new project in the country of Tambivia. This new project will produce the following cash flows, measured in TABs (the currency of Tambivia), that are expected to be repatriated to the parent company in the United States.

In addition, assume that the risk-free rate in the United States is 5 percent and that this project is riskier than most; as such, the firm has determined that it should require a 12 percent premium over the risk-free rate. Thus, the appropriate discount rate for this project is 17 percent. In addition, the current spot exchange rate is TAB0.60/$, and the one-year forward exchange rate is TAB0.57/$. What is the project’s NPV?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9781292222189

13th Global Edition

Authors: Sheridan Titman, Arthur Keown, John Martin