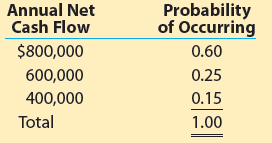

Assume Boulder Creek Industries in MAD 26-3 assigns the following probabilities to the estimated annual net cash

Question:

Assume Boulder Creek Industries in MAD 26-3 assigns the following probabilities to the estimated annual net cash flows:

a. Compute the expected value of the annual net cash flows.

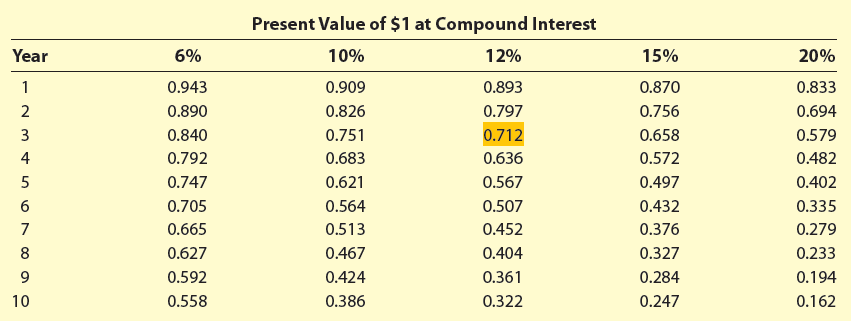

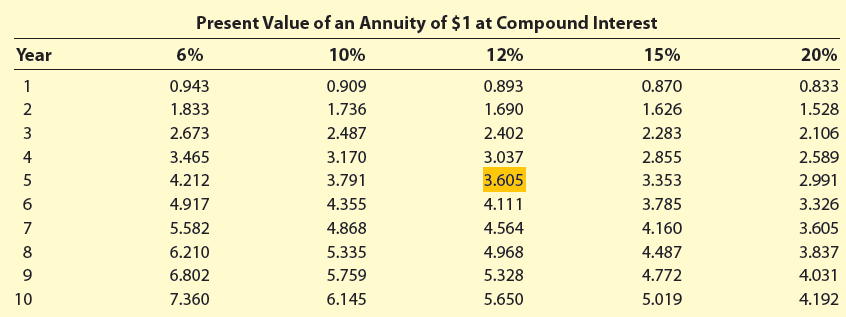

b. Determine the expected net present value of the equipment, assuming a desired rate of return of 12% and expected annual net cash flows computed in part (a). Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer.

c. Based on your results in parts (a) and (b), should Boulder Creek Industries invest in the equipment?

Exhibit 2:

Exhibit 5:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: