Based on the data in Exercise 4-21, prepare the adjusting entries for Alert Security Services Co. Data

Question:

Based on the data in Exercise 4-21, prepare the adjusting entries for Alert Security Services Co.

Data from 4-21:

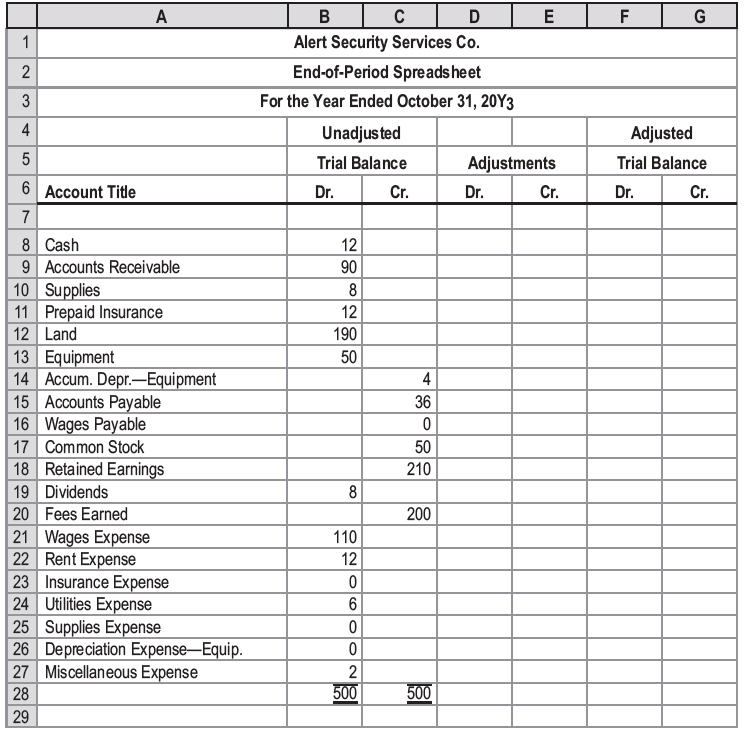

Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services has been prepared on the following end-of-period spreadsheet for the year ended October 31, 20Y3:

A Alert Security Services Co. End-of-Period Spreads heet For the Year Ended October 31, 20Y3 Unadjus ted Adjusted 5 Trial Balance Adjustments Trial Balance 6 Account Title Cr. Dr. Cr. Dr. Cr. Dr. 8 Cash 12 9 Accounts Receivable 90 10 Supplies 11 Prepaid Insurance 12 Land 13 Equipment 14 Accum. Depr.–Equipment 15 Accounts Payable 16 Wages Payable 17 Common Stock 18 Retained Earnings 19 Dividends 20 Fees Earned 21 Wages Expense 22 Rent Expense 23 Insurance Expense 24 Utilities Expense 25 Supplies Expense 26 Depreciation Expense–Equip. 27 Miscellaneous Expense 28 8 12 190 50 4 36 50 210 8 200 110 12 6 500 500 29 2. 3. 4-

Step by Step Answer:

20Y3 Adjusting Entries Oct 31 Accounts Receivable 13 Fees Earned 13 A...View the full answer

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Based on the data in Exercise 4-22, prepare the closing entries for Alert Security Services Co. Data from 4-22: Alert Security Services Co. offers security services to business clients. Complete the...

-

The unadjusted trial balance of PS Music as of July 31, 20Y5, along with the adjustment data for the two months ended July 31, 20Y5, are shown in Chapter 3. Based upon the adjustment data, the...

-

Cedar Springs Company completed the following selected transactions during June 20Y3: June 1. Established a petty cash fund of $1,000. 12. The cash sales for the day, according to the cash register...

-

Toby dies on 2 March 2021, leaving an estate valued at 400,000. None of the transfers made on death are exempt from IHT. Calculate the IHT due on the estate if the total of the gross chargeable...

-

For Problems find solutions of the given IVPs. a. dy/dt - y = 1, y(0) = 1 b. dy/dt +2ty = t3, y(1) = 1

-

In this chapter, we used a simplified equation for the combustion of gasoline. But the products generated in the operation of real automobile engines include various oxides of nitrogen, and it is...

-

Explain the difference between a single factor and a complete LO4 factorial experiment.

-

Keystone Computer Timeshare Company entered into the following transactions during May 2015. 1. Purchased computer terminals for $20,000 from Data Equipment on account. 2. Paid $3,000 cash for May...

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

There is a lottery with n coupons and n people take part in it. Each person picks exactly one coupon. Coupons are numbered consecutively from 1 to n, n being the maximum ticket number. The winner of...

-

Based on the data in Exercise 4-22, prepare an income statement, statement of stockholders equity, and balance sheet for Alert Security Services Co. During the year ended October 31, 20Y3, common...

-

The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31...

-

What is bare metal recovery?

-

Find the linear approximation at the given point: f(x) = cos(4x-) at x =

-

The labor costs of complying with national regulations in order to remain a certified provider of testing products and services to oil producers. GeoTest creates, calibrates and installs devices used...

-

Mrs. Cora Yank (age 42) is divorced and has full custody of her 10-year-old son, William. Mrs. Yank works as a medical technician in a Chicago hospital. Her salary was $38,400, from which her...

-

Midterm Project This assignment relates to the following Course Learning Requirements: CLR 1: Explain the basic components of a computer system in an office. CLR 3: Use an e-mail account and...

-

Sarah Young is planning to attend a billing conference in the next two months. Her place of employment will reimburse her for the conference price. Sarah should use which cash management for the...

-

A manufacturer reports the data below. (1) Compute the number of days in the cash conversion cycle. (2) Is the company more efficient at managing cash than its competitor who has a cash conversion...

-

a. What is the cost of borrowing if Amarjit borrows $28 500 and repays it over a four-year period? b. How many shares of each stock would he get if he used the $28 500 and invested equally in all...

-

Is it ethical to choose aggressive accounting practices to advance a companys business? During the 1990s, America Online (AOL), the largest Internet service provider in the United States, was one of...

-

On April 1, 2009, Morimoto Corporation issued $8,000,000 in 8.5 percent, five-year bonds at 98. The semiannual interest payment dates are April 1 and October 1. Prepare entries in journal form for...

-

On March 1, 2010, Fast Freight Company sold $400,000 of its 9.5 percent, 20-year bonds at 106. The semiannual interest payment dates are March 1 and September 1. The market interest rate is 8.9...

-

During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of goods sold totaled $7,140,000 (60% of sales). The company...

-

What is the value of a 15% coupon bond with 11% return? Is it a discount or a premium bond?

-

A manufacturer with a December 31 taxation year end sells new machinery for $50,000 on January 2, 2022. The cost of the machinery is $20,000. The terms of the sale require an initial payment of...

Study smarter with the SolutionInn App