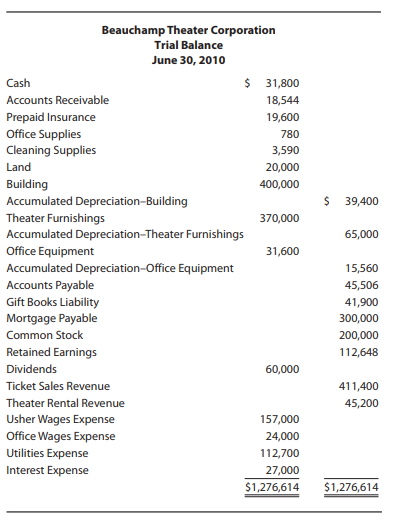

Beauchamp Theater Corporations trial balance at the end of its current fiscal year appears is given below:

Question:

Beauchamp Theater Corporation’s trial balance at the end of its current fiscal year appears is given below:

1. Enter Beauchamp Theater Corporation’s trial balance amounts in the Trial Balance columns of a work sheet and complete the work sheet using the following information:

a. Expired insurance, $17,400.

b. Inventory of unused office supplies, $244.

c. Inventory of unused cleaning supplies, $468.

d. Estimated depreciation on the building, $14,000.

e. Estimated depreciation on the theater furnishings, $36,000. f. Estimated depreciation on the office equipment, $3,160.

g. The company credits all gift books sold during the year to the Gift Books Liability account. A gift book is a booklet of ticket coupons that is purchased in advance as a gift. The recipient redeems the coupons at some point in the future. On June 30 it was estimated that $37,800 worth of the gift books had been redeemed.

h. Accrued but unpaid usher wages at the end of the accounting period, $860.

i. Estimated federal income taxes, $20,000.

2. Prepare an income statement, a statement of retained earnings, and a balance sheet.

3. Prepare adjusting and closing entries.

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson