Handbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones

Question:

Handbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 2,000 direct labor hours. The total indirect labor is budgeted to be $200,000.

Time records from indirect labor employees revealed that they spent 30% of their time setting up production runs and 70% of their time supporting actual production.

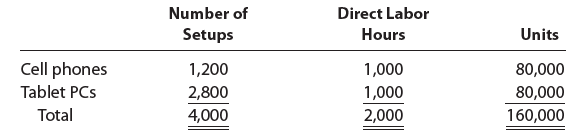

The following information about cell phones and tablet PCs was determined from the corporate records:

a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base.

b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activities—one for setup and the other for production support.

c. Determine the activity cost per unit for indirect labor allocated to each product under

activity- based costing.

d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton