Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are the two largest toy companies in North America. Condensed

Question:

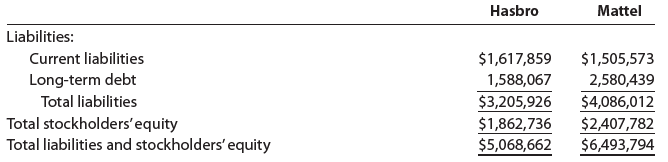

Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are the two largest toy companies in North America. Condensed liabilities and stockholders’ equity from a recent balance sheet are shown for each company as follows (in thousands):

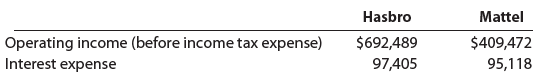

The operating income and interest expense from the income statement for each company were as follows (in thousands):

a. Determine the ratio of liabilities to stockholders’ equity for both companies. Round to one decimal place.

b. Determine the times interest earned ratio for both companies. Round to one decimal place.

c. Interpret the ratio differences between the two companies.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: