Joyous Julius, Inc., is a large retail chain that has grown quickly thanks to its successful leveraging

Question:

Joyous Julius, Inc., is a large retail chain that has grown quickly thanks to its successful leveraging of homemade-style orange julius. The company would like to narrow down the number of flavors it offers to three.

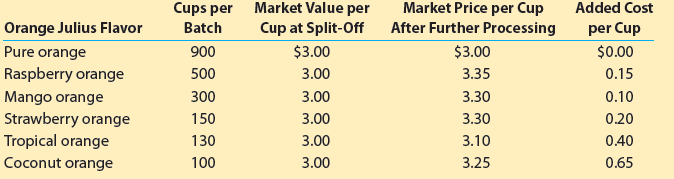

Joyous Julius, Inc., currently produces six different flavors of orange julius: pure orange, raspberry orange, mango orange, strawberry orange, tropical orange, and coconut orange. The orange julius flavors are produced jointly in a mixing process that costs a total of $2,500 per batch. At the end of each joint production batch, 900 cups of pure orange Julius are produced. Another 1,180 cups of various Julius flavors are processed further. Information about the production of each batch is summarized in the following table:

One of the by-products of the production of the orange julius is orange peels. Joyous Julius, Inc., has found a company that produces nutritional smoothies that would be willing to buy Joyous Julius’s orange peels for $40 per batch. Joyous Julius, Inc., is interested in the deal but doesn’t know how to account for these additional revenues.

a. Ignoring the company’s strategy to narrow down the number of flavors it offers, are there any flavors that Joyous Julius, Inc., should discontinue processing after the split-off

point (based on margin alone)?

b. Assuming Joyous Julius, Inc., keeps pure orange as a flavor, what other two flavors should the company keep as a flavor?

c. Assume that Joyous Julius, Inc., keeps pure orange and the two other flavors you identified in part (b) and that additional cups of the pure orange flavor replace all discontinued flavors in the joint production process. Using the net realizable value method, determine the amount of joint production costs that should be allocated to each of the remaining three products.

d. How could Joyous Julius account for the additional revenues from the sale of orange peels?

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton