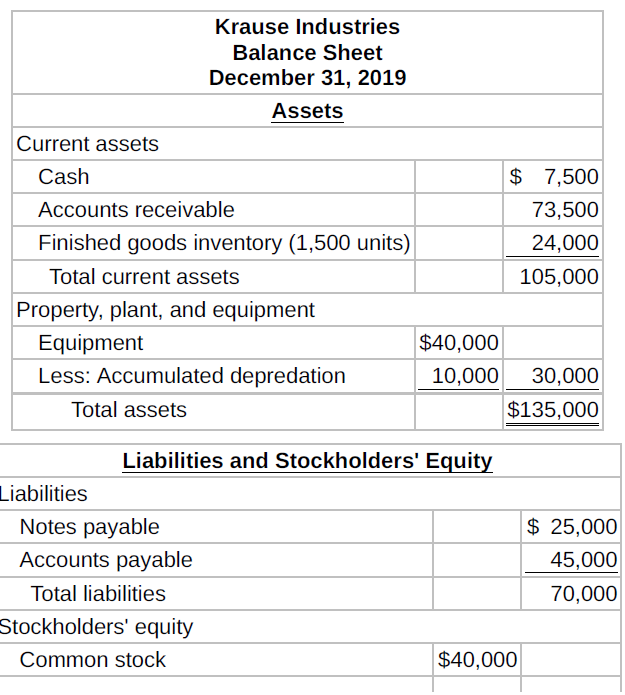

Krause Industries' balance sheet at December 31, 2019, is presented below. Budgeted data for the year 2020

Question:

Krause Industries' balance sheet at December 31, 2019, is presented below.

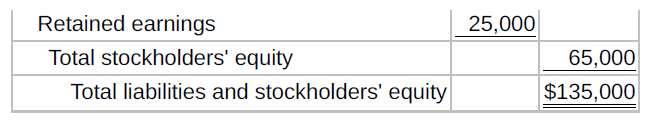

Budgeted data for the year 2020 include the following.

To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the production budget shows 9,000 required units of output. The total unit cost of production is expected to be $18. Krause uses the first-in, first-out (FIFO) inventory costing method. Interest expense is expected to be $3,500 for the year. Income taxes are expected to be 40% of income before income taxes. In 2020, the company expects to declare and pay an $8,000 cash dividend.

The company's cash budget shows an expected cash balance of $5,880 at December 31, 2020. All sales and purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid 50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were the same as the ?materials used. In 2020, the company expects to purchase additional equipment costing $9,000. $4,000 of depreciation expense on equipment is included in the budget data and split equally between manufacturing overhead and selling and administrative expenses. Krause expects to pay $8,000 on the outstanding notes payable balance plus all interest due and payable to December 31 (included in interest expense $3,500, above). Accounts payable at December 31, 2020, includes amounts due suppliers (see above) plus other accounts payable relating to manufacturing overhead of $7,200. Unpaid income taxes at December 31 will be $5,000.

Instructions

Prepare a budgeted statement of cost of goods sold, budgeted multiple-step income statement and retained earnings statement for 2020, and a budgeted classified balance sheet at December 31, 2020.

Cash BudgetA cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso