On December 31, 2020, Waters Company prepared an income statement and balance sheet, but failed to take

Question:

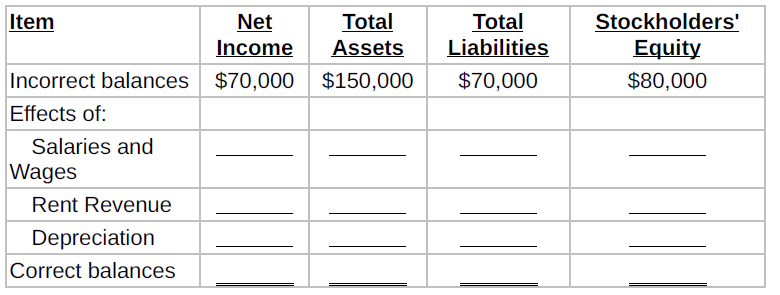

On December 31, 2020, Waters Company prepared an income statement and balance sheet, but failed to take into account three adjusting entries. The balance sheet showed total assets $150,000, total liabilities $70,000, and stockholders' equity $80,000. The incorrect income statement showed net income of $70,000.

The data for the three adjusting entries were:

- Salaries and wages amounting to $10,000 for the last 2 days in December were not paid and not recorded. The next payroll will be in January.

- ?Rent payments of $8,000 was received for two months in advance on December 1. The entire amount was credited to Unearned Rent Revenue when paid.

- Depreciation expense for 2020 is $9,000.

Instructions

Complete the following table to correct the financial statement amounts shown (indicate deductions with parentheses).

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted: