Plevin Company ended its fiscal year on July 31, 2020. The company's adjusted trial balance as of

Question:

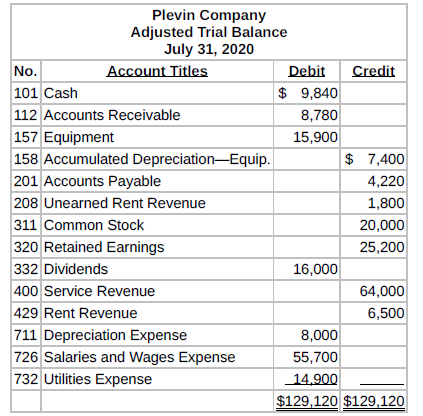

Plevin Company ended its fiscal year on July 31, 2020. The company's adjusted trial balance as of the end of its fiscal year is shown as follows.

Instructions

a. Prepare the closing entries using page J15.

b. Post to the Retained Earnings and No. 350 Income Summary accounts. (Use the three-column form.)

c. Prepare a post-closing trial balance at July 31.

Plevin Company Adjusted Trial Balance July 31, 2020 Account Titles No. Debit Credit $ 9,840 101 Cash 112 Accounts Receivable 8,780 157 Equipment 158 Accumulated Depreciation-Equip. 15,900 $ 7,400 201 Accounts Payable 4,220 208 Unearned Rent Revenue 1,800 311 Common Stock 20,000 320 Retained Earnings 25,200 332 Dividends 16,000 400 Service Revenue 64,000 429 Rent Revenue 6,500 711 Depreciation Expense 726 Salaries and Wages Expense 8,000 55,700 732 Utilities Expense 14,900 $129,120 $129,120

Step by Step Answer:

a General Journal J15 Date Account Titles Ref Debit Credit July 31 Service Revenue 400 64000 Rent Re...View the full answer

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Roth Company ended its fiscal year on July 31, 2014. The companys adjusted trial balance as of the end of its fiscal year is as shown below. Instructions (a) Prepare the closing entries using page...

-

Apachi Company ended its fiscal year on July 31, 2011. The companys adjusted trial balance as of the end of its fiscal year is as shown at the top of page 186. Instructions (a) Prepare the closing...

-

Okabe Company ended its fiscal year on July 31, 2017. The companys adjusted trial balance as of the end of its fiscal year is shown below. Instructions (a) Prepare the closing entries using page J15....

-

What is the result of executing the following method? A. The declaration of name does not compile. B. The declaration of _number does not compile. C. The declaration of profit$$$ does not compile. D....

-

What is a prepaid expense?

-

"For actively traded products traders can mark to market. For structured products they mark to model." Explain this remark.

-

Articles on tax topics are often useful in understanding the income tax law. CPA firms and other organizations publish tax articles on the Internet. Using the Guides-Tips- Help section of the Tax and...

-

Transfer-pricing dispute. The Allison-Chambers Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division...

-

Question 1 Susan Bhd's balances in the equity accounts as at 1 July 2019 were as follows: Accounts Ordinary shares Revaluation reserve Retained profits Total equity RM'000 30.000 2,000 20.000 52.000...

-

Differentiate broadly between financial accounting and managerial accounting.

-

Kay Magill Company had the following adjusted trial balance. Instructions a. Prepare closing entries at June 30, 2020. b. Prepare a post-closing trial balance. Kay Magill Company Adjusted Trial...

-

The adjusted trial balance for Plevin Company is presented in E4.8. Adjusted trial balance from E4.8 Instructions a. Prepare an income statement and a retained earnings statement for the year. b....

-

As is typical in management development or 360o feedback processes, the manager in this case has solicited feedback regarding his managerial style and, now, he faces the challenge of interpreting the...

-

The following rates are applicable to annual payroll in British Columbia Question 17 options: 1234 1.95% x total B.C. remuneration 1234 2.925% x (B.C. remuneration - $500,000) 1234 Tax Rate 1234...

-

Assume that different groups of couples use a particular method of gender selection and each couple gives birth to one baby. This method is designed to increase the likelihood that each baby will be...

-

A storeroom is used to organize items stored in it on N shelves. Shelves are numbered from 0 to N-1. The K-th shelf is dedicated to items of only one type, denoted by a positive integer A[K]....

-

CASES CASE 10.1 Money in Motion Jake Nguyen runs a nervous hand through his once finely combed hair. He loosens his once perfectly knotted silk tie. And he rubs his sweaty hands across his once...

-

(3.8) Axiom, Definition of false false = true (3.9) Axiom, Distributivity of over : (pq) p=q

-

(a) A 1.5-mm-diameter steel sphere (7830 kg/m 3 ) is dropped into a tank of SAE 30 oil. What is its terminal velocity? (b) If the sphere is instead dropped into a different oil of the same density...

-

Match each of the key terms with the definition that best fits it. _______________ A record of the sequence of data entries and the date of those entries. Here are the key terms from the chapter. The...

-

McGee Company has the following data at December 31, 2010. The available-for-sale securities are held as a long-term investment.Instructions(a) Prepare the adjusting entries to report each class of...

-

Davison Carecenters Inc. provides financing and capital to the health-care industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds...

-

In January 2010, the management of Noble Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions...

-

Use the following information for questions 2 and 3. Niles Co. has the following data related to an item of inventory: Inventory, March 1 100 units @ $4.20 Purchase, March 7 350 units @ $4.40...

-

Rotan, Inc. purchased a van on January 1, 2018, for $800,000. Estimated life of the van was five years, and its estimated residual value was $96,000. Rotan uses the straightline method of...

-

If at the beginning of a period, you buy a share of stock for $49, then receive a dividend of $3, and finally sell the stock for $51, what was your holding period return? 9.3% 10.2% 14.8% 16.3%

Study smarter with the SolutionInn App