Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of $150,000 and will

Question:

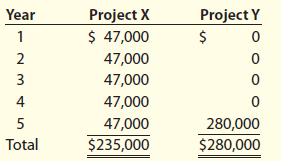

Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of $150,000 and will operate for five years. The cash flows associated with these projects are as follows:

Staten’s required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten?

a. Accept Project X and reject Project Y.

b. Accept Project Y and reject Project X.

c. Accept Projects X and Y.

d. Reject Projects X and Y.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: