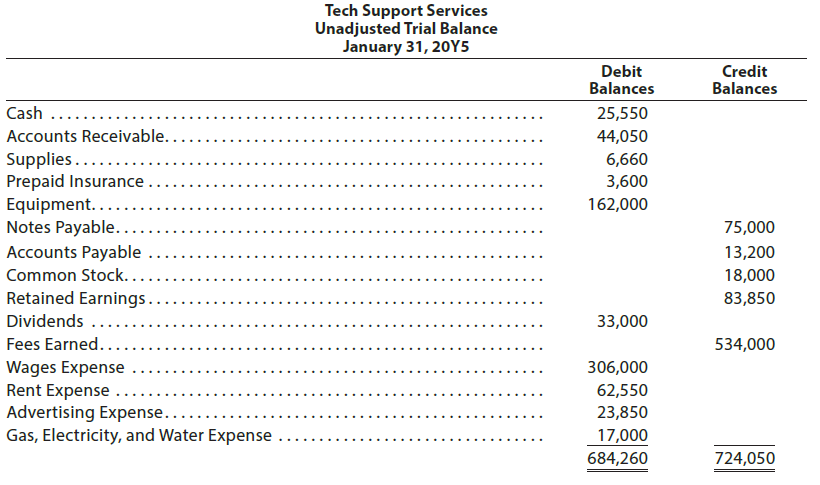

Tech Support Services has the following unadjusted trial balance as of January 31, 20Y5: The debit and

Question:

Tech Support Services has the following unadjusted trial balance as of January 31, 20Y5:

The debit and credit totals are not equal as a result of the following errors:

a. The cash entered on the trial balance was overstated by $8,000.

b. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

c. A debit of $12,350 to Accounts Receivable was not posted.

d. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

e. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid Insurance.

f. The balance of Notes Payable was overstated by $21,000.

g. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

h. A debit of $6,000 for dividends was posted as a debit to Retained Earnings.

i. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial balance.

j. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of January 31, 20Y5.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are

no errors in the accounts? Explain.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton