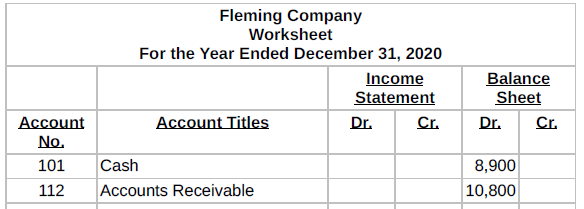

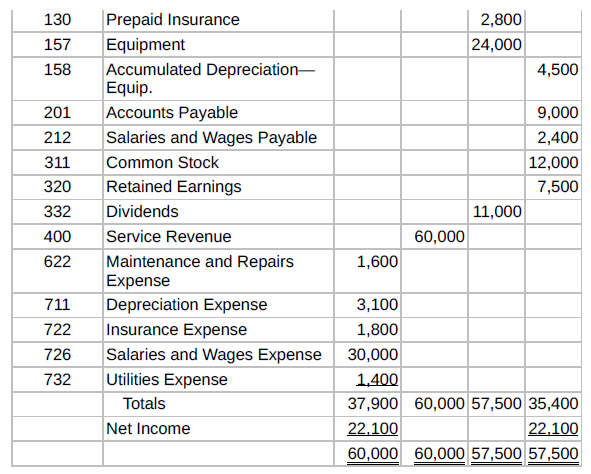

The completed financial statement columns of the worksheet for Fleming Company are as follows. Instructions a. Prepare

Question:

The completed financial statement columns of the worksheet for Fleming Company are as follows.

Instructions

a. Prepare an income statement, a retained earnings statement, and a classified balance sheet.

b. Prepare the closing entries.

c. Post the closing entries and underline and balance the accounts. (Use T accounts.) Income Summary is account No. 350.

d. Prepare a post-closing trial balance.

Fleming Company Worksheet For the Year Ended December 31, 2020 Balance Sheet Income Statement Account Titles Cr. Dr. Account Dr. Cr. No. Cash 101 8,900 112 Accounts Receivable 10,800 130 Prepaid Insurance Equipment Accumulated Depreciation- Equip. 2,800 157 24,000 158 4,500 201 Accounts Payable 9,000 212 Salaries and Wages Payable 2,400 311 Common Stock 12,000 320 Retained Earnings 7,500 332 Dividends |11,000 400 Service Revenue 60,000 622 Maintenance and Repairs Expense 1,600 711 Depreciation Expense 3,100 722 Insurance Expense 1,800 726 Salaries and Wages Expense 30,000 732 Utilities Expense 1,400 Totals 37,900 60,000 57,500 35,400 Net Income 22,100 22,100 60,000 60,000 57,500 57,500

Step by Step Answer:

a FLEMING COMPANY Income Statement For the Year Ended December 31 2020 Revenues Service revenue 60000 Expenses Salaries and wages expense 30000 Depreciation expense 3100 Insurance expense 1800 Mainten...View the full answer

Financial and Managerial Accounting

ISBN: 978-1119392132

3rd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The completed financial statement columns of the worksheet for Muddy Company are shown below. Instructions(a) Prepare an income statement, an owner??s equity statement, and a classified balance...

-

The completed financial statement columns of the worksheet for Woods Company Inc. are shown below. Instructions (a) Prepare an income statement, a retained earnings statement, and a classified...

-

The completed financial statement columns of the worksheet for Yulon Company, Ltd. are as follows. Instructions (a) Prepare an income statement, a retained earnings statement, and a classified...

-

Which annotations will trigger a compiler error if incorrectly applied to a method with no other annotations? (Choose three.) A. @Documented B. @Deprecated C. @SuppressWarnings("unchecked") D....

-

What is the depreciation method that is used for tax purposes? How is it different than the methods that are used for financial purposes?

-

Use the information from the table in problem 7, but now assume that that the variable costs are also reduced from $7 to $6. How will this affect the results?

-

Assume a finite population has 350 elements. Using the last three digits of each of the following five-digit random numbers (e.g., 601, 022, 448, . . . ), determine the first four elements that will...

-

Lockboxes and Collection it takes Cookie Cutter Modular Homes, Inc., about six days to receive and deposit checks from customers. Cookie Cutters management is considering a lockbox system to reduce...

-

Your financial planner offers you two different investment plans. Plan X is an annual perpetuity of $28,000. Plan Y is an annuity for 13 years and an annual payment of $35,000. Both plans will make...

-

Solstice Fitness Co. (Solstice) is a privately owned chain of high-end fitness clubs offering a range of services and amenities to its members, including state-of-the-art fitness facilities, group...

-

Worksheet data for DeSousa Company are presented in E4.2. Instructions Prepare an income statement, a retained earnings statement, and a classified balance sheet. Worksheet from E4.2 DeSousa Company...

-

Worksheet data for DeSousa Company are presented in E4.2. Instructions a. Journalize the closing entries at April 30. b. Post the closing entries to Income Summary and Retained Earnings. (Use...

-

Allocating a service center cost to operating departments The administrative department of Andrews Consulting, LLC, provides office administration and professional support to its two operating...

-

When leaders are facing a crisis or an opportunity, generally, they tend to fall back on the leadership style that has worked for them in the past. Discuss with examples the options that would help...

-

Data Table the pasteet dollar -X Total sales revenues 2 Number of units produced and sold 500,000 units Selling price nt. $ 230,000 te Operating Income Total Investment in assets Variable cost per...

-

Figure < 4 ft/s 45 0.75 ft 3 ft/s 1.50 ft 1 of 1 < Part A Determine the velocity of point A on the rim of the gear at the instant shown.(Figure 1) Enter the x and y components of the velocity...

-

what ways can leaders facilitate cognitive reframing and emotional regulation techniques to promote constructive conflict resolution ?

-

What is the level of sales needed to achieve a 10% return on an investment of $10,000,000 for a restaurant (the restaurant has main products it sells: food, beverage and gift shop items) and cover...

-

A sprinter runs using a force of 200 N and a power output of 600 W. Calculate how many minutes it takes for the runner to run 1 km.

-

Controls can be identified based on their function. The functions are preventive, detective, and corrective. A. True B. False

-

For the data presented in BE16-4, show the financial statement presentation of the trading securities and related accounts.

-

Garrett Corporation holds as a long-term investment available-for-sale stock securities costing $72,000. At December 31, 2010, the fair value of the securities is $66,000. Prepare the adjusting entry...

-

For the data presented in BE16-6, show the financial statement presentation of the available-for-sale securities and related accounts. Assume the available-for-sale securities are noncurrent.

-

Kaidan Inc. is a Japanese firm located in Osaka. The firm's expenses contribute to the firm's revenue in a different period than when they are paid. Suppose that the firm's salaries and wages are...

-

Belmont contributes $30,000 to the Salvation Army. Belmont's marginal tax rate is 24% while his average tax rate is 20%. After considering his tax savings, Belmont's contribution costs A) $7,200. B)...

-

non 6 Which symbol is used to represent a decision in flowcharts? et ered Sout of 1.0 Select one O a. og question Ob. . O d

Study smarter with the SolutionInn App