The Golden Nursery School Corporation provides baby-sitting and child-care programs. On January 31, 2010, the company had

Question:

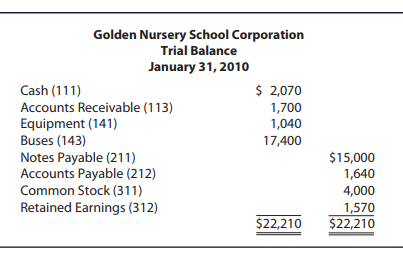

The Golden Nursery School Corporation provides baby-sitting and child-care programs. On January 31, 2010, the company had the following trial balance:

During the month of February, the company completed the following transactions:

Feb. 2 Paid this month’s rent, $400.

3 Received fees for this month’s services, $650.

4 Purchased supplies on account, $85.

5 Reimbursed the bus driver for gas expenses, $40.

6 Ordered playground equipment, $1,000.

8 Made a payment on account, $170.

9 Received payments from customers on account, $1,200.

10 Billed customers who had not yet paid for this month’s services, $700.

11 Paid for the supplies purchased on February 4.

13 Received and paid cash for playground equipment ordered on February 6, $1,000.

17 Purchased equipment on account, $290.

19 Paid this month’s utility bill, $145.

22 Received payment for one month’s services from customers previously billed, $500.

26 Paid part-time assistants for services, $460.

27 Purchased gas and oil for the bus on account, $325.

28 Declared and paid a dividend of $200.

Required

1. Open accounts in the ledger for the accounts in the trial balance plus the following ones: Supplies (115); Dividends (313); Service Revenue (411); Rent Expense (511); Gas and Oil Expense (512); Wages Expense (513); and Utilities Expense (514).

2. Enter the January 31, 2010, account balances from the trial balance.

3. Enter the above transactions in the general journal

4. Post the entries to the ledger accounts. Be sure to make the appropriate posting references in the journal and ledger as you post.

5. Prepare a trial balance as of February 28, 2010.

6. Examine the transactions for February 3, 9, 10, and 22. What were the revenues and how much cash was received from the revenues? What business issue might you see arising from the differences in these numbers?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson