Using the information for Sarot, Inc., in SE 4, SE 5, and SE 9, compute the price/earnings

Question:

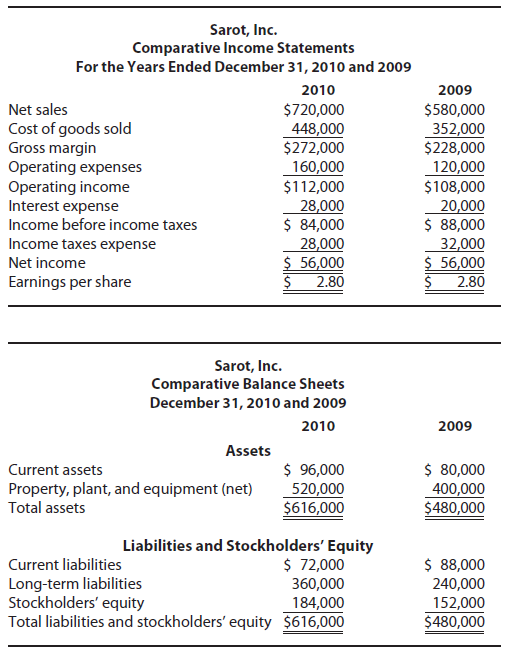

Using the information for Sarot, Inc., in SE 4, SE 5, and SE 9, compute the price/earnings (P/E) ratio and dividends yield for 2009 and 2010. The company had 20,000 shares of common stock outstanding in both years. The price of Sarot’s common stock was $60 in 2009 and $40 in 2010. Comment on the results. (Round computations to one decimal place.)

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Financial Accounting

ISBN: 9780538755160

11th Edition

Authors: Belverd E Needles, Marian Powers

Question Posted: