Assuming that historical data suggests that the market risk premium is 8.4 percent per year and the

Question:

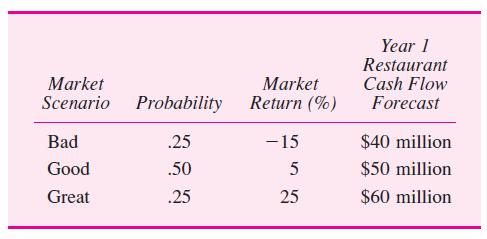

Assuming that historical data suggests that the market risk premium is 8.4 percent per year and the market standard deviation is 40 percent per year, find the certainty equivalent of the year 1 cash flow. What are the advantages and disadvantages of using such historical data for market inputs as opposed to inputs from a set of scenarios, like those given in the table above exercise 11.2?

Assume that Marriott’s restaurant division has the following joint distribution with the market return:AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman

Question Posted: