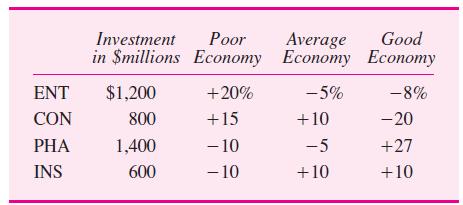

Assuming that the three economic outcomes (1) have an equal likelihood of occurring and (2) that the

Question:

Assuming that the three economic outcomes (1)

have an equal likelihood of occurring and (2) that the good economy is twice as likely to take place as the other two:

a. Calculate individual expected returns for each subsidiary.

b. Calculate implicit portfolio weights for each subsidiary and an expected return and variance for the equity in the ABCO conglomerate.

ABCO is a conglomerate that has $4 billion in common stock. Its capital is invested in four subsidiaries:

entertainment (NET), consumer products (CON), pharmaceuticals (PHA), and insurance (INS). The four subsidiaries are expected to perform differently, depending on the economic environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman