Consider a two-factor model, where the factors are interest rate movements and changes in the exchange rate.

Question:

Consider a two-factor model, where the factors are interest rate movements and changes in the exchange rate. Your company has a future cash flow with factor betas of 2 on the interest rate factor and 5 on the exchange rate factor. You would like to eliminate your sensitivity to both of these factors by means of financial securities, but do not wish to use any of the company’s cash to do this.

The following investment opportunities are available to you.

• You can purchase 30-year government bonds.

• You can enter into a 2-year interest rate swap agreement.

• You can invest in a foreign index fund.

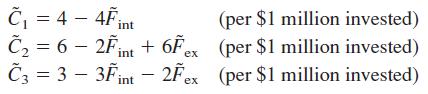

The following factor equations, with the two factors being changes in interest rates and changes in exchange rates, correspond to the future values of the three investment opportunities, respectively.

Design a proper hedge against interest rate movements and exchange rates in this environment.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman