Let Bt price per $100 of face value of a zerocoupon bond maturing at year t. Then,

Question:

Let Bt price per $100 of face value of a zerocoupon bond maturing at year t. Then, if B1 $94.00, B2 $88.20, B3 $81.50, B4 $76.00, and B5 $73.00, implying that the term structure of interest rates is no longer flat:

a. Determine zero-coupon rates for years 1 through 5 to the nearest .01 percent.

b. Let’s now reconsider the tracking portfolio in exercise 10.4. What is the cost or revenue associated with such a tracking portfolio at date 0 under the new term structure?

c. What is the NPV of project X under the new term structure?

d. How are your answers to parts b and c related?

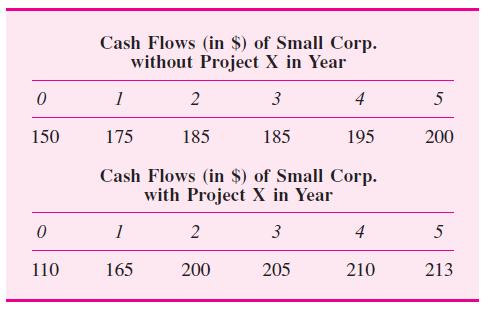

Small Corp. is investigating a possible new project, project X, which would affect corporate cash flow as follows:AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman