The following tree diagram outlines the price of a stock over the next two periods: The risk-free

Question:

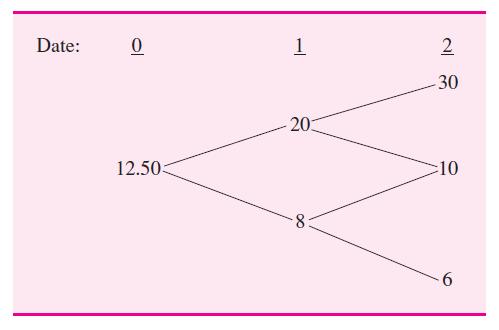

The following tree diagram outlines the price of a stock over the next two periods:

The risk-free rate is 12 percent from date 0 to date 1 and 15 percent from date 1 to date 2. A European call on this stock (1) expires in period 2 and (2) has a strike price of $8.

(a) Calculate the risk-neutral probabilities implied by the binomial tree.

(b) Calculate the payoffs of the call option at each of three nodes at date 2.

(c) Compute the value of the call at date 0.

AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman

Question Posted: