Consider a European-style call option maturing in five months, with strike price (K= 40), written on a

Question:

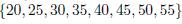

Consider a European-style call option maturing in five months, with strike price \(K=€ 40\), written on a stock share with current price \(S(0)=€ 35\). We (very unrealistically) assume that the uncertainty about the stock price at maturity \(T=512\) may be represented by eight equally likely scenarios: \(S(T)\)

. Find the expected value of the option payoff.

. Find the expected value of the option payoff.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: