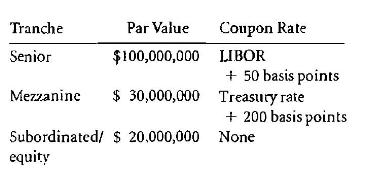

Consider the following basic ($ 150) million (mathrm{CDO}) structure with the coupon rate to be offered at

Question:

Consider the following basic \(\$ 150\) million \(\mathrm{CDO}\) structure with the coupon rate to be offered at the time of issuance as shown:

Assume the following:

- The collateral consists of bonds that all mature in 10 years.

- The coupon rate for every bond is the 10-year Treasury rate plus 300 basis points.

- The collateral manager enters into an interest rate swap agreernent with another party with a notional amount of \(\$ 100\) million.

- In the interest rate swap the collateral manager agrees to pay a fixed rate each year equal to the 10-year Treasury rate plus 100 basis points and recive \(L J B O R\)

a. Why is an interest rate swap needed?

b. What is the potential return for the subordinate/ equity tranche, assuming no defaults?

c. Why will the actual return be less than the return computed?

Step by Step Answer:

Foundations Of Financial Markets And Institutions

ISBN: 9780136135319

4th Edition

Authors: Frank J Fabozzi, Franco G Modigliani, Frank J Jones