Let us consider a market index for a tiny market, on which just 3 stocks are traded.

Question:

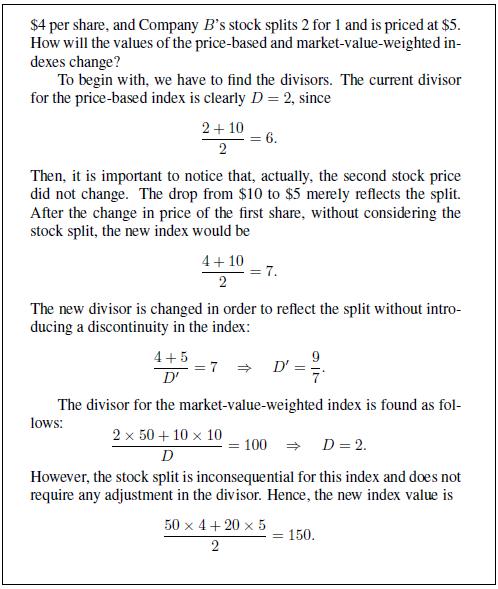

Let us consider a market index for a tiny market, on which just 3 stocks are traded. In this market, 50,000 shares of the first firm are outstanding, 100,000 of the second one, and 80,000 of the third one. The index is a weighted-average of the three stock prices, reflecting the capitalization of the three firms. The current stock prices are \(€ 50\), €30, and \(€ 45\), respectively. To make the index easy to read and nondimensional, it is divided by a divisor (established once for all and kept constant in time; we rule out exceptional events like those described in Example 1.17); assume that with that choice of divisor, the index now is 118. We also assume that the stock shares do not pay any dividend.

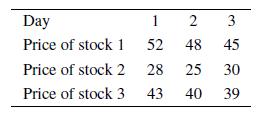

The following table lists the stock prices (in EUR) for a three-day scenario (a single sample path):

Data From Example 1.17

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte