Lookback options are a family of exotic, path-dependent options where the payoff depends on the maximum or

Question:

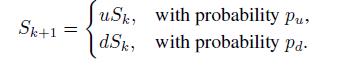

Lookback options are a family of exotic, path-dependent options where the payoff depends on the maximum or the minimum price of the underlying asset, observed along the sample path up to maturity. For instance, the option payoff could be

![]()

where is the asset price at maturity and \(S_{\max }\) is the maximum observed price on the time interval

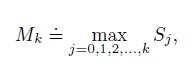

is the asset price at maturity and \(S_{\max }\) is the maximum observed price on the time interval ![]() . Let us assume a binomial, discrete-time process where

. Let us assume a binomial, discrete-time process where

The price dynamics is clearly Markovian, but the maximum price so far,

seems to introduce an unavoidable path dependence, destroying the Markov property. Actually, we may notice that can be defined recursively as

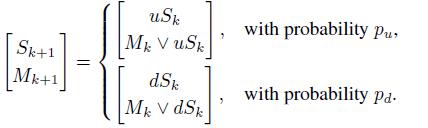

can be defined recursively as

![]()

where we introduce the common shorthand ![]() . This suggests the possibility of augmenting the state variable, which is now a vector with two components, whose state transition equation is

. This suggests the possibility of augmenting the state variable, which is now a vector with two components, whose state transition equation is

The trick of augmenting the state space is a general strategy that can be attempted, in order to transform a non-Markov process into a Markov one. In practice, needless to say, it can only be pursued when it leads to a moderate increase in the size of the state space.

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte