Table 1.2 illustrates a possible scenario in a trade on gold futures. On day 1 , when

Question:

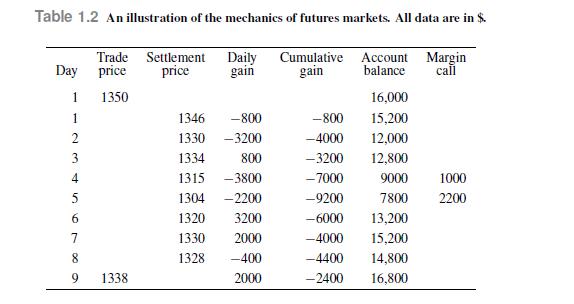

Table 1.2 illustrates a possible scenario in a trade on gold futures. On day 1 , when the gold futures price is \(\$ 1350\) per ounce, we enter a long position for two contracts, whose unit size is 100 ounces (hence, each contract specifies the purchase of 100 ounces of gold at a total price of \(\$ 135,000)\). The initial margin required by the broker is \(\$ 8000\) per contract, hence, we have to deposit \(\$ 16,000\) on the margin account immediately. The maintenance margin is \(\$ 5000\) per contract. At end of day 1 , the futures is settled at \(\$ 1346\). Hence, we have a cash flow

\[\$(1346 \quad 1350) \quad 200=\$ 800\]

which is actually a loss, as the futures price declined and we hold a long position. In Table 1.2, we list the settlement price for a sequence of days, resulting in daily gains, which are cumulated. The margin account falls below the maintenance margin at the end of day 4. After marking-to-market, the margin account balance is only \(\$ 9000\), and \(\$ 1000\) have to be posted in order to restore the maintenance margin. We get another margin call after the settlement of the next day. At some time during day 9 , when the futures price is \(\$ 1338\), we close the contract, with a total loss of \(\$ 2400\).

Data From Table 1.2

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte