To see how an arbitrage opportunity may arise if parity is violated, say that the two-year rates

Question:

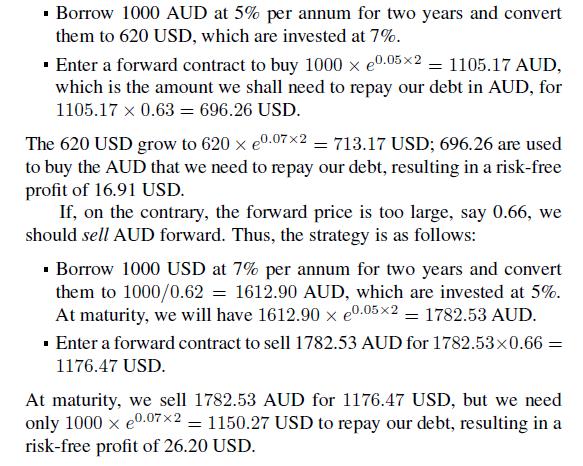

To see how an arbitrage opportunity may arise if parity is violated, say that the two-year rates in Australia and the USA are 5% and 7%, respectively, and that the spot price of 1 AUD is \(0.62 \mathrm{USD}\). Then, the two-year forward price should be

Now assume that \(F\left(\begin{array}{ll}0, & 2\end{array}\right)=0.63\). The forward price is lower than it should be, so it is cheap to buy AUD forward. Then, we can:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: