We are strongly bearish about stock shares of DotBomb. Hence, we sell 1000 shares at the current

Question:

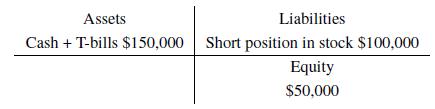

We are strongly bearish about stock shares of DotBomb. Hence, we sell 1000 shares at the current price of \(\$ 100\). The proceeds, \(\$ 100,000\), are deposited in our margin account, together with some collateral. If the initial margin required is \(50 \%\), we must deposit a corresponding amount in cash or rather safe securities, e.g., T-bills. The initial situation is as follows:

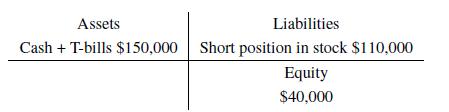

If we are right, and DotBomb falls to \(\$ 70\), we can close our position out and earn \$30,000 (neglecting commissions and interest). If, however, DotBomb rises to \(\$ 110\), the new situation is

and the margin ratio drops to

\[\frac{\$ 40000}{\$ 110000}=36 \%\]

How much can the stock price increase, before we get a margin call? If the maintenance ratio is \(30 \%\), we must find a stock price \(P\) such that

\[\frac{\$ 150000 \quad 1000 P}{1000 P}=30 \%\]

By solving for \(P\), we obtain \(P_{\text {lim }}=\$ 11538\).

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte