You are the manager of a pension fund, and your fee depends on the achieved annual return.

Question:

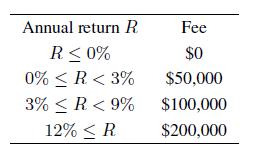

You are the manager of a pension fund, and your fee depends on the achieved annual return. You can play it safe, and allocate wealth to a risk-free portfolio earning \(4 \%\) per year (with annual compounding). Alternatively, you can pursue an active portfolio management strategy, whose return is modeled by a normal random variable with expected value \(8 \%\) and standard deviation \(10 \%\). Your fee depends on the realized performance, according to the following table:

- Assume that you do not care about your own risk, so that you just consider expected values. Which one is the better strategy for you?

- What is the standard deviation of your fee, if you take the active strategy?

Step by Step Answer:

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte