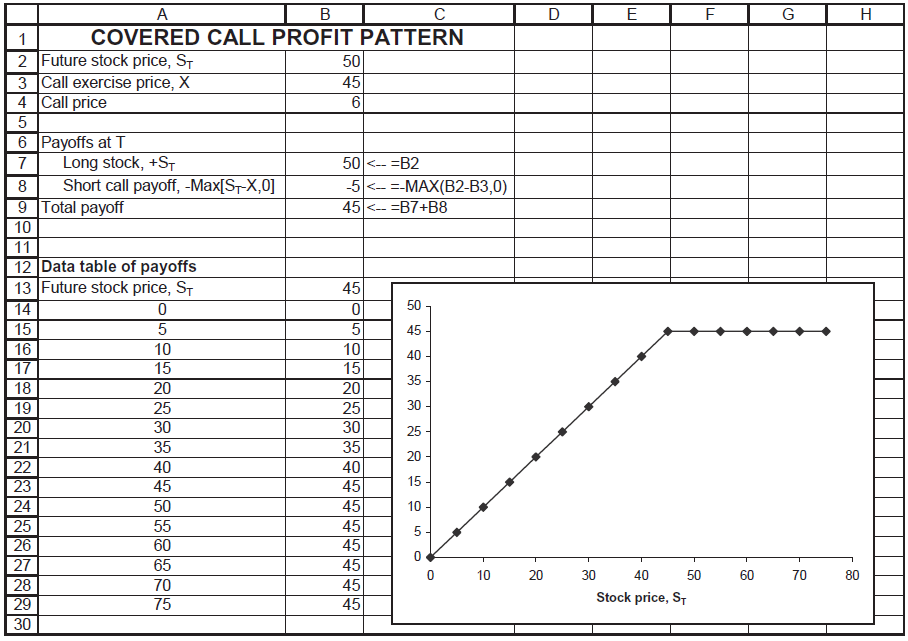

A covered call is a long stock and short call. The pattern of payoffs is given below:

Question:

A covered call is a long stock and short call. The pattern of payoffs is given below:

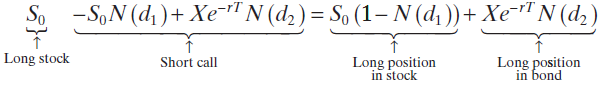

In this problem, you are asked to simulate the payoffs of a covered call over 52 weeks, with weekly updating of the positions. Start by deriving the formula for the covered call: Add together the Black-Scholes price and the stock price:

Thus we see that a covered call is a long position in the stock and a long position in the bond. Now implement the following spreadsheet to test the effectiveness of a simulated covered call strategy.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: