Question: Consider a case of five possible rating states, A, B, C, D, and E. States A, B, and C are initial bond ratings, D symbolizes

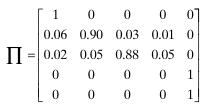

Consider a case of five possible rating states, A, B, C, D, and E. States A, B, and C are initial bond ratings, D symbolizes first-time default, and E indicates default in the previous period. Assume that the transition matrix Π is given by

A 10-year bond issued today at par with an A rating is assumed to bear a coupon rate of 7 percent.

a. If a bond is issued today at par with a B rating and with a recovery percentage of 50 percent, what should its coupon rate be so that its expected return will also be 7 percent?

b. If a bond is issued today at par with a C rating and with a recovery percentage of 50 percent, what should its coupon rate be so that its expected return will be 7 percent?

1 0 0 0 00 0 0.06 0.90 0.03 0.02 0.05 0.88 0.01 0 0.05 0 0 0 0 0 1 0 0 0 0 1

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts