The previous example assumes that the risk-free rate is constant. An alternative, perhaps more plausible, model might

Question:

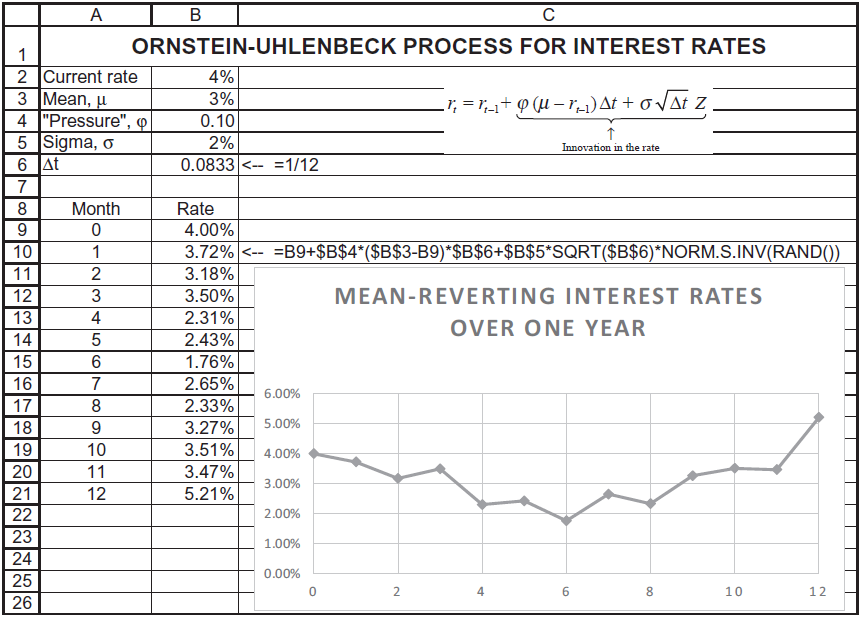

The previous example assumes that the risk-free rate is constant. An alternative, perhaps more plausible, model might be to assume that the risk-free rate is mean reverting, with a long-run mean. Under this assumption, if the current rate is above the long-run mean, the next period rate will tend downward, and vice versa. One such model is the Ornstein-Uhlenbeck process:

Simulate this process over 12 months:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: